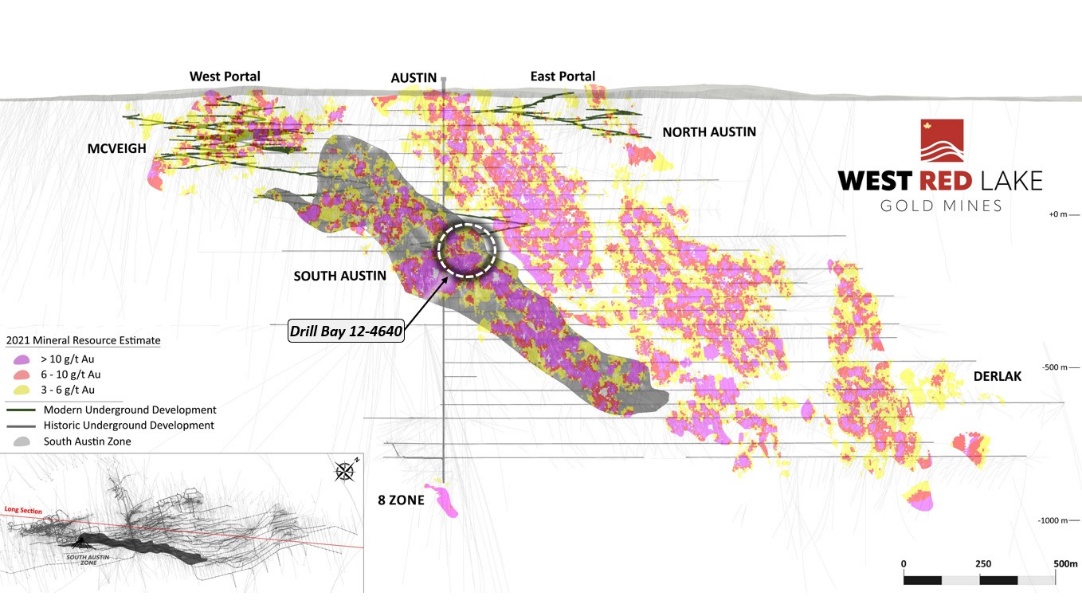

In a press release dated March 4, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) drill results from the high-grade South Austin Zone, which currently contains an Indicated mineral resource of 474,600 ounces, grading 8.7 grams per tonne gold, with an additional Inferred resource of 31,800 oz grading 8.7 g/t Au.

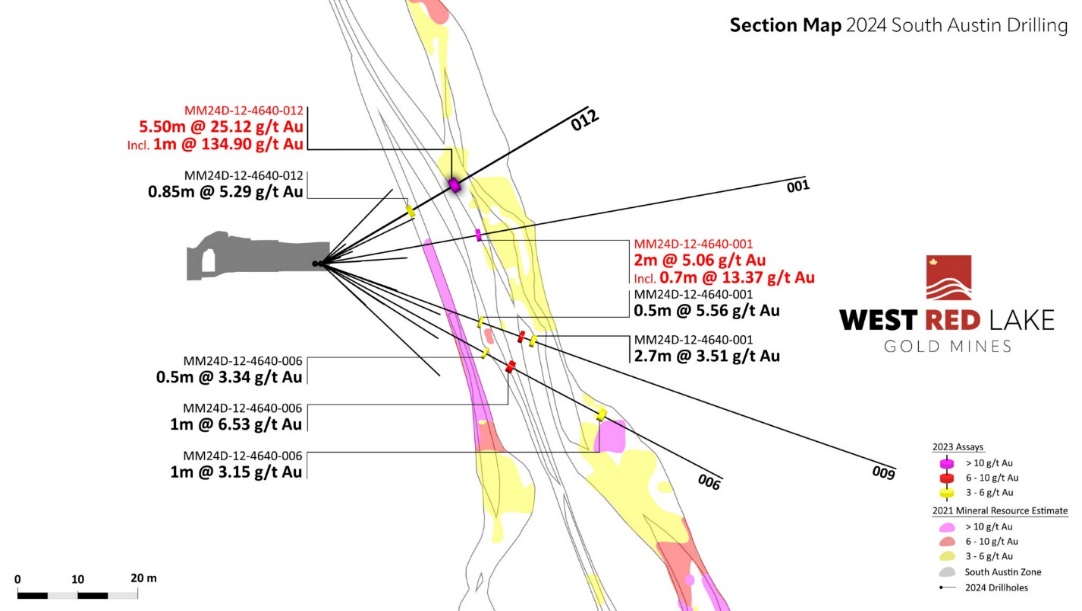

“We hit some high-grade intercepts, with visible gold showings,” Will Robinson VP of Exploration told Guy Bennett, CEO of Global Stocks News. “When the team saw that, we added additional holes to that station to flush those areas out, up dip and down.”

“We planned this program so that we could be nimble, stay fluid,” continued Robinson. “We’re not just drilling a station, moving off it, and waiting for the results. We’re focused on maximising exploration dollars and building high confidence ounces, in preparation for our plan to restart the Madsen Mine.”

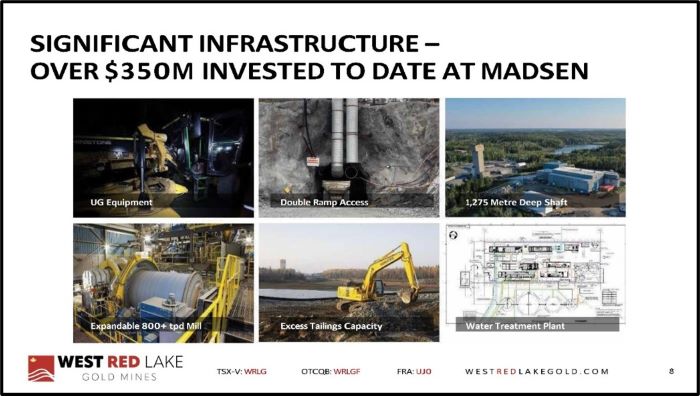

The company’s flagship asset – The Madsen Gold Mine – is debt free, fully permitted, with a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [ 1 ]

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

This asset was once valued at over a billion dollars, about 8X the current market cap of WRLG. There is smart money heavily invested in the current project – Frank Guistra (11.8%); Sprott Resource (23.4%).

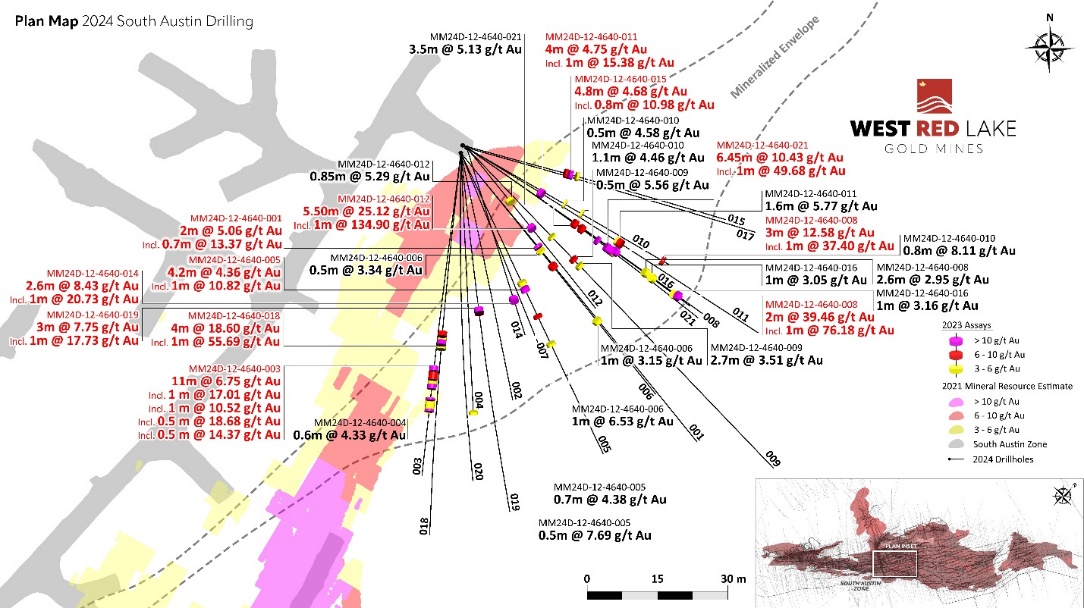

March 4, 2024 Drill Highlights:

-

Hole MM24D-12-4640-012 Intersected 5.5m @ 25.12 g/t Au, from 24.0m to 29.5m, Including 1.0m @ 134.90 g/t Au, from 25.0m to 26.0m.

-

Hole MM24D-12-4640-008 Intersected 3.0m @ 12.58 g/t Au, from 45.0m to 48.0m, Including 1m @ 37.40 g/t Au, from 45.0m to 46.0m; And 2.0m @ 39.46 g/t Au, from 64.0m to 66.0m, Including 1.0m @ 76.18 g/t Au, from 64.0m to 65.0m.

-

Hole MM24D-12-4640-018 Intersected 4.0m @ 18.60 g/t Au, from 41.0m to 45.0m, Including 1.0m @ 55.69 g/t Au, from 43.0m to 44.0m.

-

Hole MM24D-12-4640-003 Intersected 11.0m @ 6.75 g/t Au, from 47.0m to 58.0m, Including 1.0m @ 17.01 g/t Au, from 47.0m to 48.0m, Also including 1.0m @ 10.52 g/t Au, from 51.0m to 52.0m; Also Including 0.5m @ 18.68 g/t Au, from 54.0m to 54.5m, Also including 0.5m @ 14.37 g/t Au, from 56.5m to 57.0m.

-

Hole MM24D-12-4640-021 Intersected 6.45m @ 10.43 g/t Au, from 36.0m to 42.45m, Including 0.75m @ 49.68 g/t Au, from 39.25m to 40.0m.

-

Hole MM24D-12-4640-019 Intersected 3.0m @ 7.75 g/t Au, from 35.0m to 38.0m, Including 1.0m @ 17.73 g/t Au, from 35.0m to 36.0m.

“The team has been making great progress de-risking the Madsen deposit with definition drilling as we continue to build up an inventory of high-grade and high-confidence ounces that will prove invaluable during the initial ramping up of mine production,” stated WRLG President & CEO Shane Willams in the March 4, 2024 press release.

“The Mine Operations team is working in tandem with geology to ensure the underground drills get to the highest priority areas of the deposit,” continued Williams. “The excellent results highlighted in this release are indicative of the upside that still exists at Madsen even within the current life-of-mine resource inventory.”

The strategy for the Madsen Mine Restart is: 1. De-risk Resources (in-fill and expansion drilling, UG development; 2. Restart Planning (engineering, mill expansion assessment, optimisation; 3. Restart Execution (assembling team, community relations, focus on operability and profitability).

“The previous operator was under-capitalised,” Willams told Bennett. “Debt repayment obligations forced the company into a quick-to-cash-flow mine model that was ultimately expensive and inefficient”.

The profitability of a potential future mine at Madsen will be impacted by the price of gold. Gold is currently at an all time high of USD $2,186. Gold is up 5% in the last week, and 18% in the last 12 months.

There is growing sentiment that the U.S. accumulated debt is going to sink the value of the U.S. dollar.

“Who thinks this is sustainable?” asked WRLG co-founder and shareholder Frank Giustra on X. “The U.S. national debt is rising by $1 trillion about every 100 days.”

https://twitter.com/Frank_Giustra/status/1763653676969967759

A long chain of zeros can be difficult to mentally process. Approximately 100 million U.S. citizens pay income tax to the federal government. Currently, each of those tax payers is burdened with an additional $100 debt per day (about $35,000 per year.)

There is no model, no projection, no blue-sky story that explains how this money can ever be re-paid. If you’ve tried living off your credit cards, you know how this story ends.

Because the debt is based on fiat currency (paper money), it is easy to manipulate supply, by printing more money.

No act of Congress can magically make a tonne of gold appear on the lawn of the White House.

In this inflationary environment, investing in hard assets like gold can be an effective strategy to protect and grow wealth.

One of the key drivers of the bullish gold price momentum is “de-dollarization” by Central governments.

“The World Gold Council reported that central banks bought 1,037 tons of gold in 2023 (worth $80 billion) just below the all-time record from 2022,” stated Business Insider.

“China’s gold-buying spree has been going strong for 16 consecutive months.

The People’s Bank of China added roughly 390,000 troy ounces of the key metal in February, according to government data cited by Bloomberg on Thursday. In total, China’s central bank holds 72.58 million troy ounces of gold, or roughly 2,257 tons.”

“We have been focusing drill programs to test gold values in the Austin, North Austin, and South Austin Zones at Madsen,” Jill Christmann Chief Geologist at told Bennett.

“On November 21, 2023 initial drilling at the North Austin Zone returned intercepts of 27.15 g/t gold over 10.28 meters and 22.31 g/t gold over 8.5 meters.

On December 5, 2023, we reported intercepts at the South Austin zone of 47.44 g/t gold over 3.2 meters and 21.64 g/t gold over 7 meters and 296.83 g/t gold over 1 meter.

On February 7, 2024 we reported 9.15 g/t gold over 3.3 meters and 10.66 g/t gold over 2.6 meters at North Austin Zone.

Much of the opportunity for growth within the North and South Austin extensions is an unmined area, away from historic workings.

“The purpose of this drilling was definition within South Austin to continue building an inventory of high-confidence ounces for eventual restart of the Madsen mill,” stated WRLG in the March 4, 2024 press release. “Notably, visible gold was observed in holes MM24D-12-4640-008 and -012.”

“Based on these observations, additional holes were added to the drill station to further define these high-grade zones up and down plunge.”

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Contact: guy.bennett@globalstocksnews.com