On June 5, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) stated that the company “has a goal to restart the high-grade Madsen gold mine in the second half of 2025.”

The announcement of a projected mine restart date is significant news.

During an aggressive 12-month drill program confirming and extending multiple high-grade zones at the Madsen project, WRLG has consistently stressed the need for patience.

“Shane Williams and West Red Lake Gold Mines are in no big rush to put the dormant Madsen Mine back into production,” reported Northern Ontario Business (NAB) on August 18th, 2023.

“The Vancouver gold company intends to take a methodical approach to set things right and deep dive into the deposit before resuming production at the shuttered underground mine.”

“It’s 18 to 24 months before we even think about switching the thing back on,” WRLG CEO Shane Williams told NAB 10 months ago.

“Our CEO Shane Williams has been clear,” confirmed Jill Christmann, WRLG Chief Geologist in a subsequent message to shareholders. “The mill turns on when it’s ready to turn on.”

There are mining CEOs who specialise in project-generation, mergers, off-take agreements and greenfield exploration.

Williams’ specific expertise is moving mineral assets along the development chain into production, on schedule and on budget. He has designed, built and operated mines (open pit and underground) in Greece, Turkey and Canada – for Skeena Resources, Eldorado Gold and Rio Tinto.

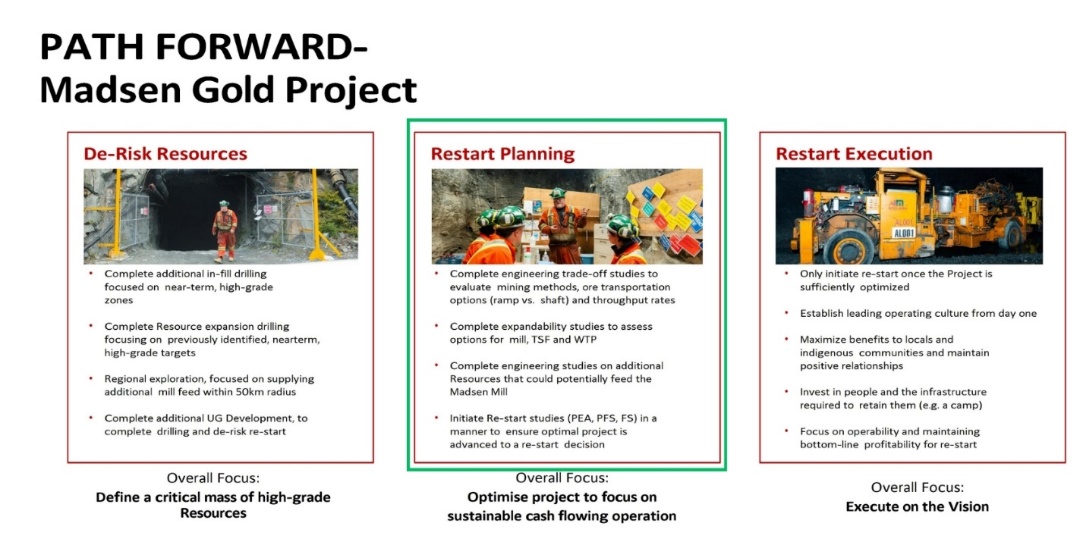

WRLG is currently working on a pre-feasibility study detailing the restart plan. This study is targeted for release in early 2025.

Mine Restart Projects Underway or Imminent:

-

Connection Drift: 1,200-meter haulage way to connect the East and West portals/declines to enable bigger trucks, more efficient routings, and better ventilation and to eliminate surface trucking restrictions by moving mineralization underground.

-

Primary Crusher: Install a permanent primary crusher as part of the Madsen mill, which previously relied on a temporary leased crusher.

-

Test Mining: Initiate a test mining program to assess longhole stoping and cut-and-fill mining methods on the range of mining environments at Madsen. This will be an essential step in further de-risking the asset.

-

Bulk Sample: Analyze samples from the test mining program through a sample tower to determine representative grade of a bulk sample.

-

Camp: Procure and install a mine camp to house 100 workers at the Madsen mine site.

-

Mine Dry: Procure, install, and staff a facility with showers, change areas, and laundry where workers can transition into and out of work shifts.

-

Evaporators: Install two (2) evaporator fans with the ability to manage 2,000 cubic meters of water daily, to increase overall water management capacity at the mine site.

-

Shaft Rehabilitation: Continue the process of dewatering the mine and rehabilitating the existing shaft, which is now certified to move people for the purpose of inspecting shaft conditions.

For the remainder of 2024 WRLG plans to have two diamond drills operating regularly in a program totaling up to 39,000 meters, with two primary objectives:

-

Resource Definition Drilling: (70%) of the drilling (approximately 27,000 meters) will be used to increase resource confidence across all known resource domains (Austin, North Austin, South Austin, and McVeigh)

-

Resource Expansion Drilling: (30%) of the drilling (approximately 12,000 meters) will test the Company’s top targets including Austin extension and the 8 Zone down plunge extension target

“We are keen to continue building confidence in the Madsen resource with definition holes ahead of our prefeasibility study,” stated Will Robinson, VP of Exploration. “And to test additional high caliber targets close to existing underground infrastructure where historic drill intercepts suggest there is good potential to define additional mineralization, like the 8 Zone.”

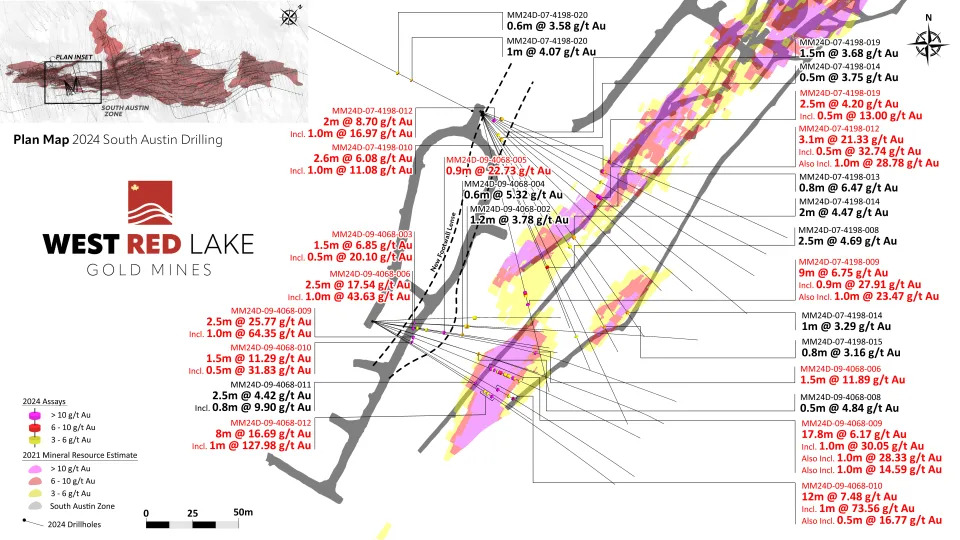

Six days after the mine restart announcement, on June 11, 2024 WRLG reported drill results focused on the high-grade South Austin Zone.

The purpose of this drilling was definition within South Austin to continue building an inventory of high-confidence ounces for the eventual restart of production at the Madsen mine.

HIGHLIGHTS:

-

Hole MM24D-09-4068-012 Intersected 8m @ 16.69 g/t Au, from 73m to 81m, Including 1m @ 127.98 g/t Au, from 78m to 79m

-

Hole MM24D-09-4068-009 Intersected 17.83m @ 6.17 g/t Au, from 69.00m to 86.83m, Including 1m @ 30.05 g/t Au, from 69m to 70m

-

Hole MM24D-09-4068-010 Intersected 12m @ 7.48 g/t Au, from 79m to 91m, Including 1m @ 73.56 g/t Au, from 80m to 81m

-

Hole MM24D-07-4198-012 Intersected 3.1m @ 21.33 g/t Au, from 83.9m to 87.0m, Including 0.5m @ 32.74 g/t Au, from 85.5m to 86.0m

-

Hole MM24D-09-4068-009 Intersected 2.48m @ 25.77 g/t Au, from 22.00m to 24.48m, Including 0.98m @ 64.35 g/t Au, from 23.50m to 24.48m.

-

Hole MM24D-07-4198-009 Intersected 9m @ 6.75 g/t Au, from 103m to 112m, Including 0.9m @ 27.91 g/t Au, from 104.0m to 104.9m

-

Hole MM24D-09-4068-006 Intersected 2.5m @ 17.54 g/t Au, from 21.0m to 23.5m, Including 1m @ 43.63 g/t Au, from 22m to 23m.

The drilling extended parts of South Austin, added confidence in a known part of the zone, and defined a new, previously unrecognized footwall lens running sub-parallel to the South Austin zone.

“We are encouraged by the very broad intercepts of mineralization averaging above 6 grams per tonne gold, which are accentuated by a number of very high-grade intervals,” stated Williams. “The new mineralized lens the team is defining footwall to South Austin between the historic 7 and 9 Levels is quite exciting and demonstrates the discovery potential that still exists within and adjacent to the Madsen deposit.”

“Typically, gold prices are linked to U.S. dollars,” stated WRLG major shareholder Frank Giustra. “However, excessive printing of dollars is diminishing their worth.”

“A global monetary system reset appears to be in progress, with a growing list of nations exploring options beyond the U.S. dollar, indicating a shift towards dedollarization,” added Giustra.

“The established financial world order of the past 50 years is now transitioning to a new and unknown paradigm as the petrodollar agreement between the U.S. and Saudi Arabia was allowed to expire this past Sunday,” reported Kitco News on June 13, 2024.

“I’m sure Saudi Arabia the UAE and Iran, like Russia, will be glad to accept #gold in trade settlement for their oil instead of USD,” stated Jaime Carrasco with Canaccord Genuity Financial.

The Madsen Gold Mine is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

“With a year of work under our belts at Madsen, we know what needs to be procured, built, and developed at the mine site over the next six to twelve months to achieve our goal of restarting the mine in 2025,” stated Williams in the June 5, 2024 press release.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid GSN $1,500 CND for the research, writing and dissemination of this content.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca