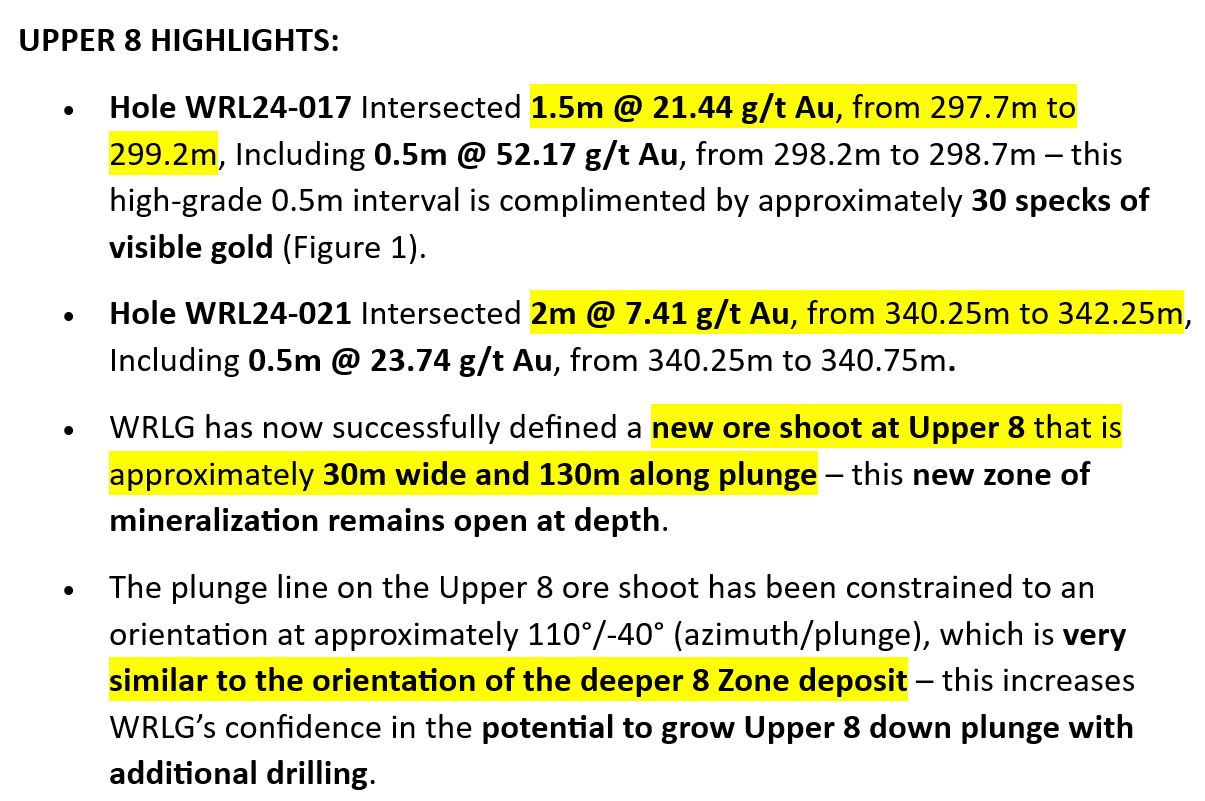

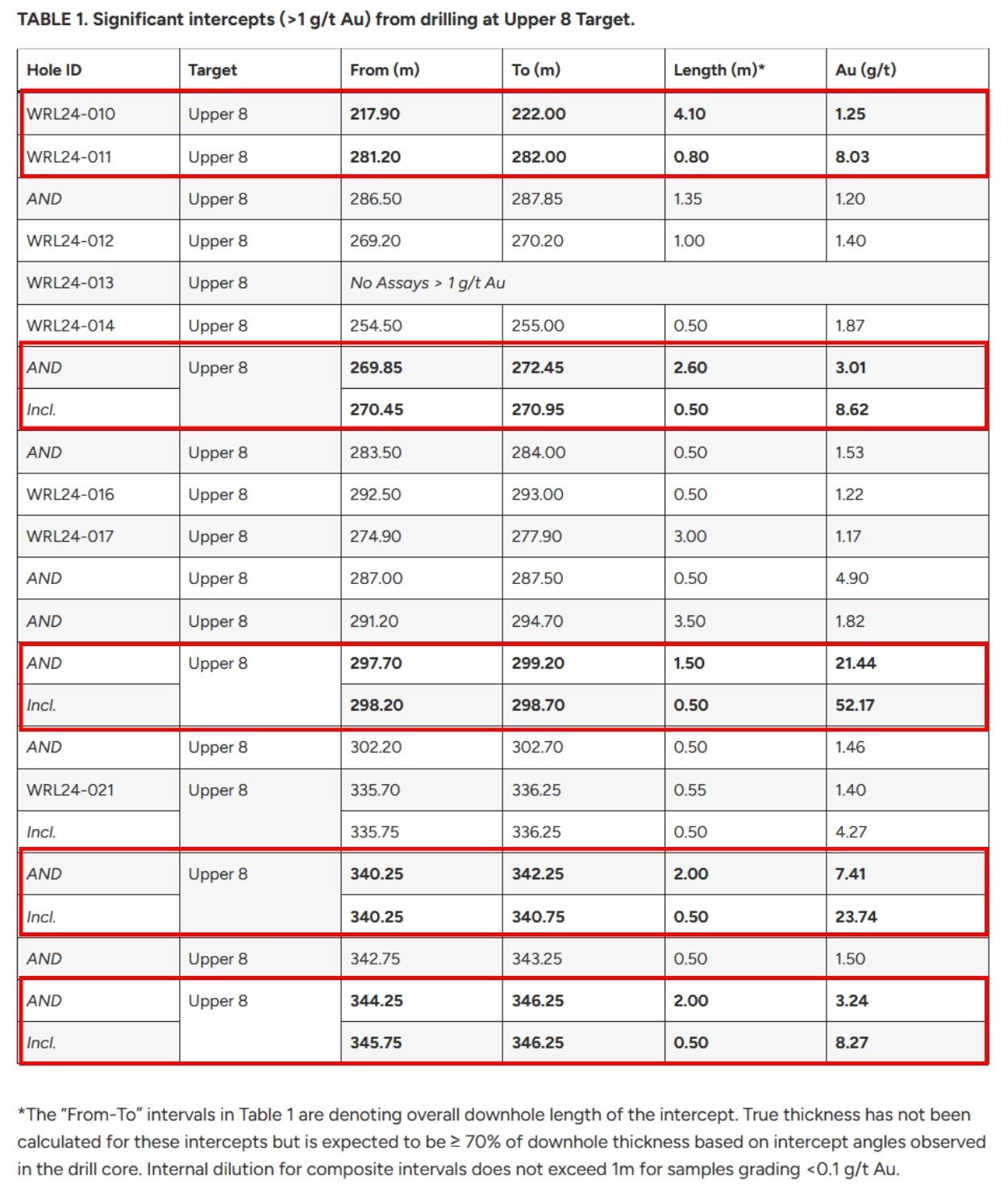

Vancouver, BC, November 26, 2024 – Sponsored content disseminated on behalf of West Red Lake Gold. On November 21, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported additional drill results that define a new ore shoot at the Upper 8 Target following up on the October 2, 2024 intercepts of 44.17 g/t Au over 1.3 meters and 20.63 g/t Au over 0.5 meters.

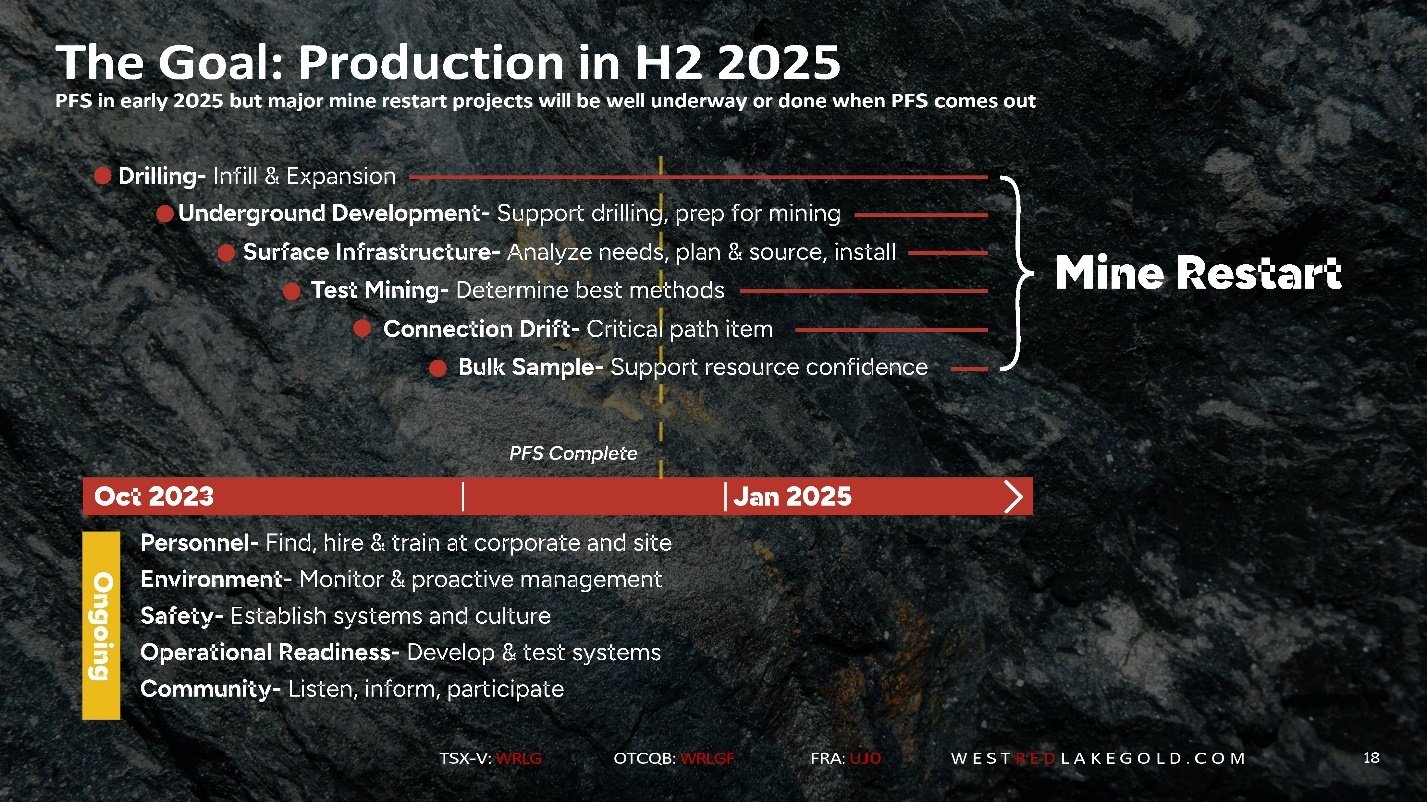

West Red Lake Gold Mines is currently working towards a restart at the Madsen Gold Mine in the Red Lake Gold District of Northwest Ontario, Canada. A Pre-Feasibility Study (PFS) for the Madsen Mine is targeted for release in early 2025. The WRLG management team projects a mine-restart date in 2025.

“Our main objective this year with the surface drill program was to make new discoveries,” Will Robinson, VP of Exploration told Guy Bennett, CEO of Global Stocks News (GSN). “We have been focusing on drill targets generated from our conceptual modeling that possess the geologic potential to produce high grades.”

“The initial results we received from Upper 8 were very encouraging and motivated our team to add a second drill to focus solely on this new high-grade area,” stated Shane Williams, WRLG President and CEO in the November 21, 2024 press release.

“Upper 8 was already a shallow geologic analog to the deeper 8 Zone, but with the exceptional grades and visible gold showings we’re now encountering, this target is becoming truly reminiscent of the high-grade gold mineralization Red Lake is known for,” continued Williams.

“It’s still early days, but we believe the Upper 8 target has the potential to become the next new significant discovery in the Red Lake gold camp and supports the likelihood for the presence of more high-grade deposits like 8-Zone yet to be discovered across the Madsen property.”

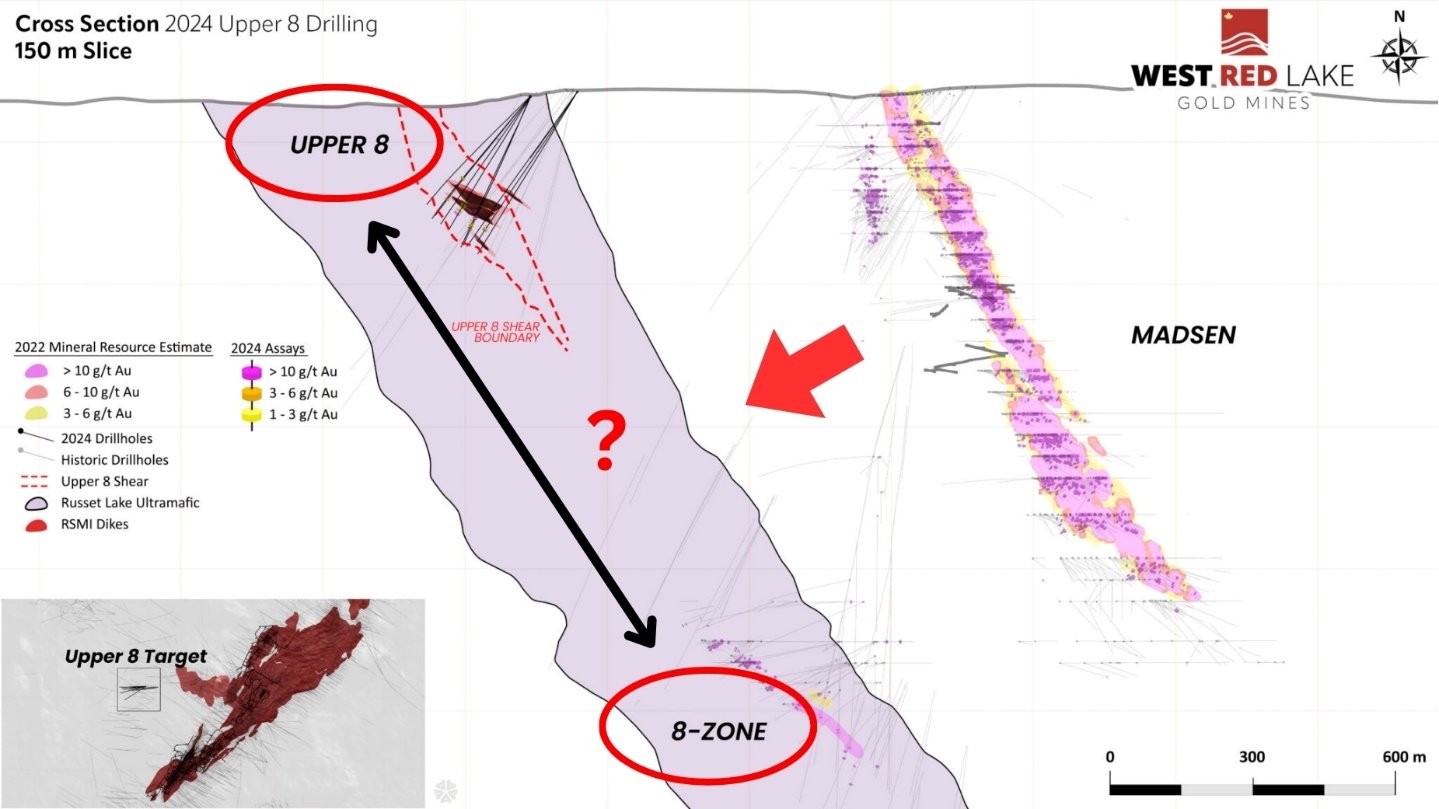

“If you compare 8-Zone with Upper 8, you’ll see the structural repetition in the way the mineralisation is oriented in these two shoots,” confirmed Robinson. “Our theory is that we may have one or two more of these zones stacked between Upper 8 and the deeper 8-Zone. Next year, we’ll get back in there with the drill, to test that theory.”

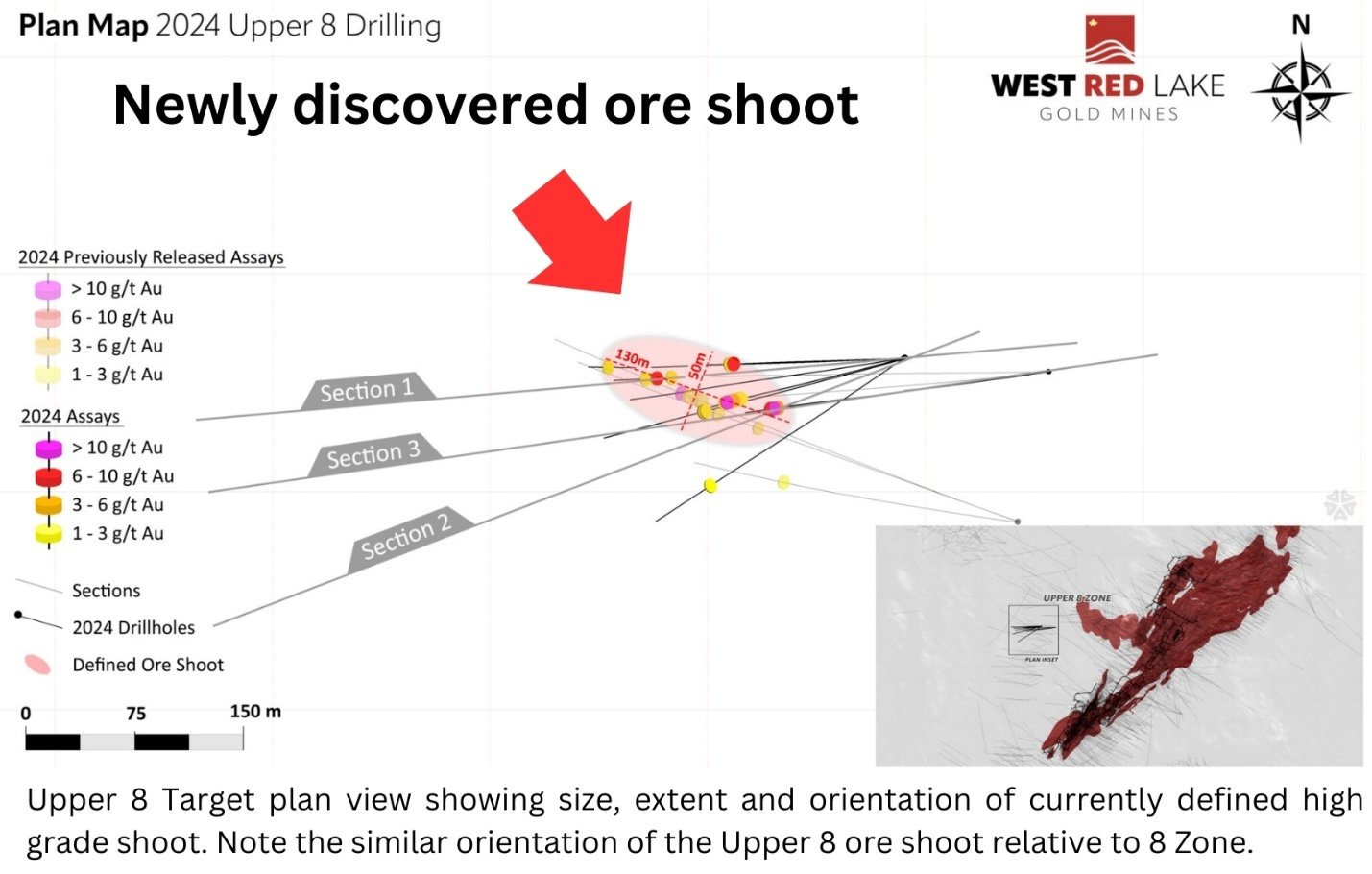

The Upper 8 target is hosted within the same lithologic unit (Russet Lake Ultramafic) approximately 750m up-plunge from the main 8-Zone deposit.

Its location in ultramafic rocks, its style of mineralization, and its exceptionally high grades make the 8 Zone geologically unique from the main Madsen deposit.

The 8 Zone currently contains an Indicated mineral resource of 87,700 ounces @ 18 grams/tonne gold, with an additional Inferred resource of 18,200 oz @ 14.6 grams/tonne gold.

“The size of the Upper 8 shoot that we’ve defined is similar in size and scale to the deeper high-grade 8 Zone,” Robinson told GSN. “The new shoot is 30 meters wide and 130 meters along plunge. We’ve only got 15 or 16 holes in the Upper 8. We are in an early stage of drilling on this target, but I’m encouraged by what we’re seeing. The geology is holding together.”

“The Pre-Feasibility Study (PFS) for the Madsen Mine is nearing completion,” stated WRLG in the November 21, 2024 press release. “The final phase of this study involves optimizing underground development and infrastructure sequencing and refining the associated operating and capital costs. West Red Lake Gold is working with SRK Consulting on these optimization opportunities, a process that is expected to take an additional few weeks to complete. As such the PFS is now targeted for release early in 2025”.

The WRLG Pre Feasibility study will be based on:

1. Real Costing: Operating underground at the Madsen Mine for the last year means West Red Lake Gold understands the real costs for blasting, mucking, and haulage of mined material.

2. Final Engineering: The Madsen Mine is essentially built. With the mine having operated as recently as 2022 and with West Red Lake Gold having studied and remedied many of the issues from that period over the last 18 months, there are very few unresolved engineering questions at Madsen.

3. Detailed Mine Plan: West Red Lake Gold has built a detailed mine design for the first 18 months of operation and intends to have 24 months of definition drilled in-situ mineral inventory defined prior to restart, which is targeted for mid-2025. This level of operational readiness far exceeds what is typical at the PFS stage in most development scenarios.

“Today, a tight labour market has made filling mining jobs harder than ever,” reports the Canadian Mining Journal. “Headhunting has become widespread, negotiations have gotten more complex, and as the industry is experiencing a wave of retirements.”

“Training is extremely important,” Robinson told GSN, acknowledging the challenge. “So are working conditions. We have a beautiful new camp at the mine site. Every room has its own restroom. That’s a perk usually reserved for top brass. A lot of the workforce live locally in Red Lake. But we have diesel mechanics, welders and pipe fitters flying in from other areas. In this tight labour market, the quality of the camp is an important part of worker retention.”

West Red Lake has partnered with Horizon North to provide the 114-person accommodations and mine dry facilities for the Madsen mine site.

Typical Horizon North Facility Built for Canadian Mining Camps

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca