Disseminated on behalf of Nations Royalty. On June 20, 2024 Nations Royalty (TSXV: NRC) announced its approval for listing on Tier 2 of the TSX Venture Exchange.

NRC’s stated goal is “to grow into a top global royalty company, specializing in Indigenous-owned royalties and revenue streams in precious metals and critical minerals, oil and gas and renewable energy.”

One week after it began trading, Nations Royalty is already the largest majority Indigenous-owned public company on the planet.

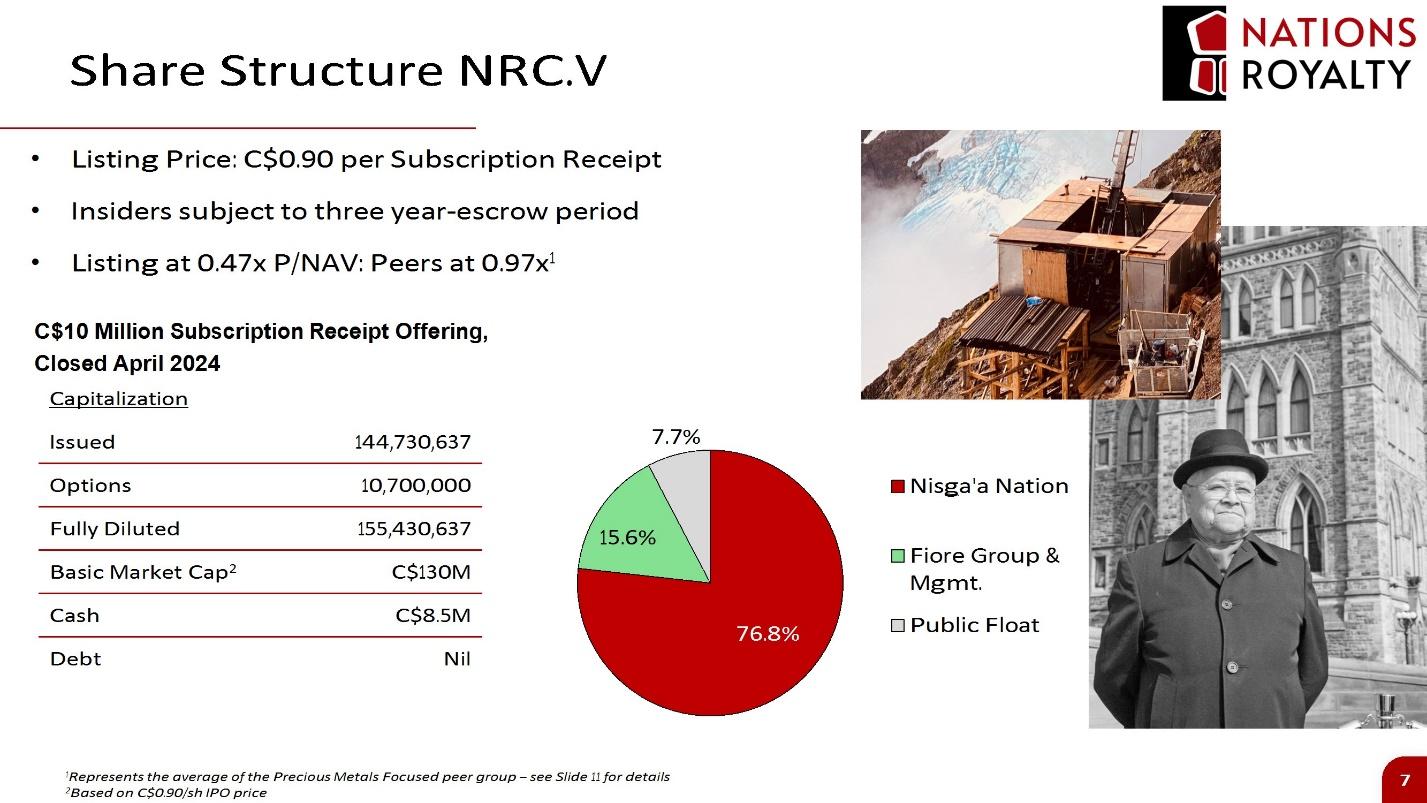

NRC has a market cap of about CAD $130 million. The Nisga’a own 76.8% of the company and have a controlling presence on the board. The board can not be expanded without Nisga’a approval.

It is difficult to overstate what a watershed moment this is for the Canadian mining industry, and Indigenous communities.

The Nations Royalty founders include mining financier and philanthropist Frank Giustra. The objective of the company is to build a powerful investment vehicle creating wealth for Indigenous groups and other NRC shareholders.

Key Highlights:

-

Five Nisga’a Benefits Agreement Royalties with a NAV of US$214M

-

Brings Value Forward from royalties onto Indigenous Groups Balance Sheets

-

Over 150 Benefit Agreements across Canada in NRC Database

-

Many Indigenous Groups to be long-term shareholders

-

Acquisition of additional royalties for predominantly share consideration

-

Potential dividends to shareholders

-

Platform for Indigenous Groups to diversify their royalties

-

Develop and promote senior Indigenous mining talent

-

Appeals to ESG-focused investors

Most veteran resource investors understand what a mining royalty is, but some younger ESG investors, may not.

If bankers knew how to read drill logs, royalty companies wouldn’t exist. Lacking the geological expertise to accurately assess risk – big banks typically tremble at the knees when they get close to a proposed mine site.

Stepping into the financing void left by legacy banks, royalty companies give cash to miners in exchange for a share of the mine’s future production.

Royalty shareholders side-step a lot of the downside risk of exploration and mining, because they don’t own drill-rigs or transport trucks.

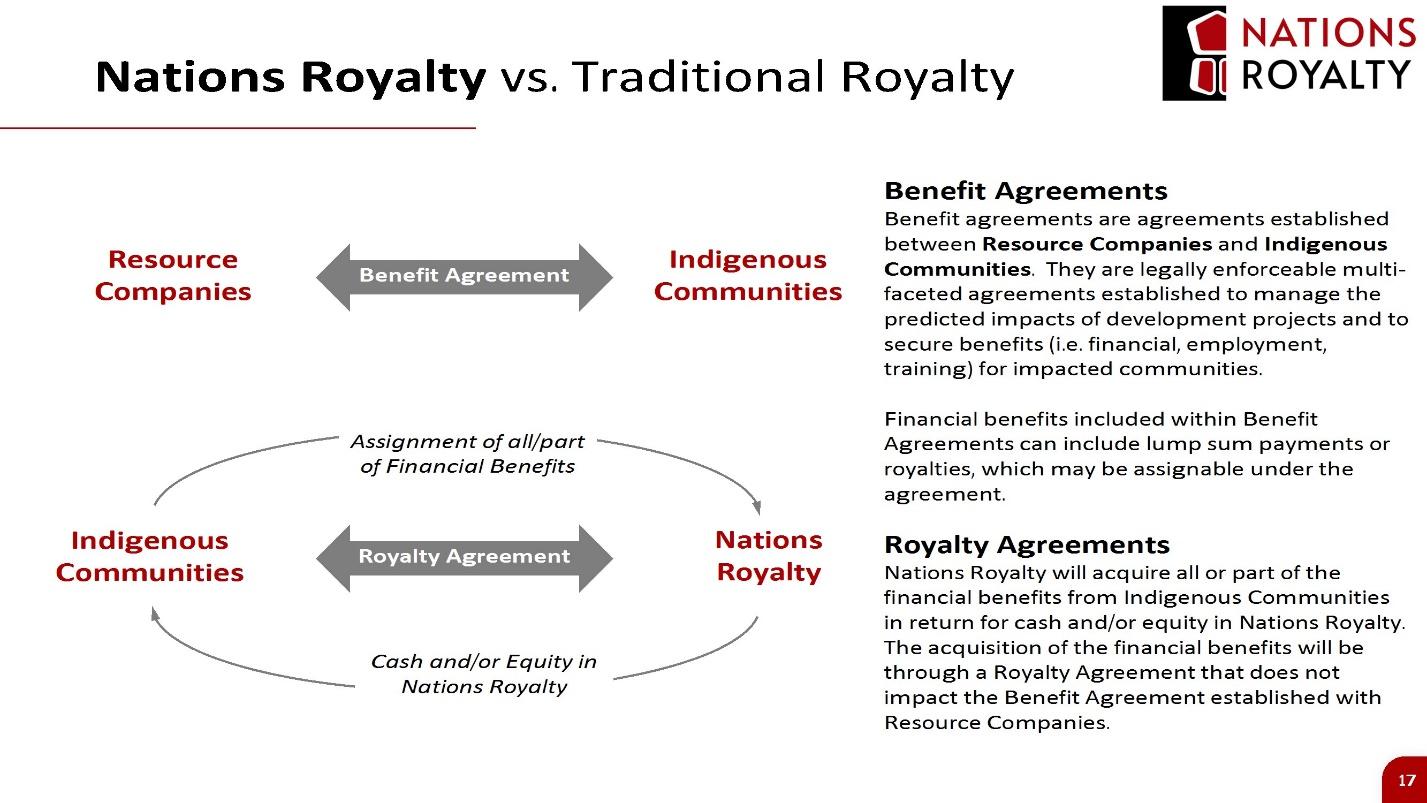

Mining companies often grant indigenous groups royalties in exchange for land usage rights. Each party is giving up something of value, and gaining something in return. The miners surrender future profits to gain land access. The Indigenous groups put their environment, culture, wildlife and people at risk to gain a financial stake in the resource project.

“Nations Royalty’s vision presents a unique opportunity for the Nisga’a Nation, other First Nations and Indigenous groups, and investors to access a portfolio encompassing precious and critical metal mines, oil and gas ventures, and renewable energy projects,” stated Eva Clayton President of the Nisga’a Lisims Government.

“With guidance from renowned mining entrepreneur, Frank Giustra, our ambition is to grow Nations Royalty into one of the top global royalty companies,” added Clayton.

.

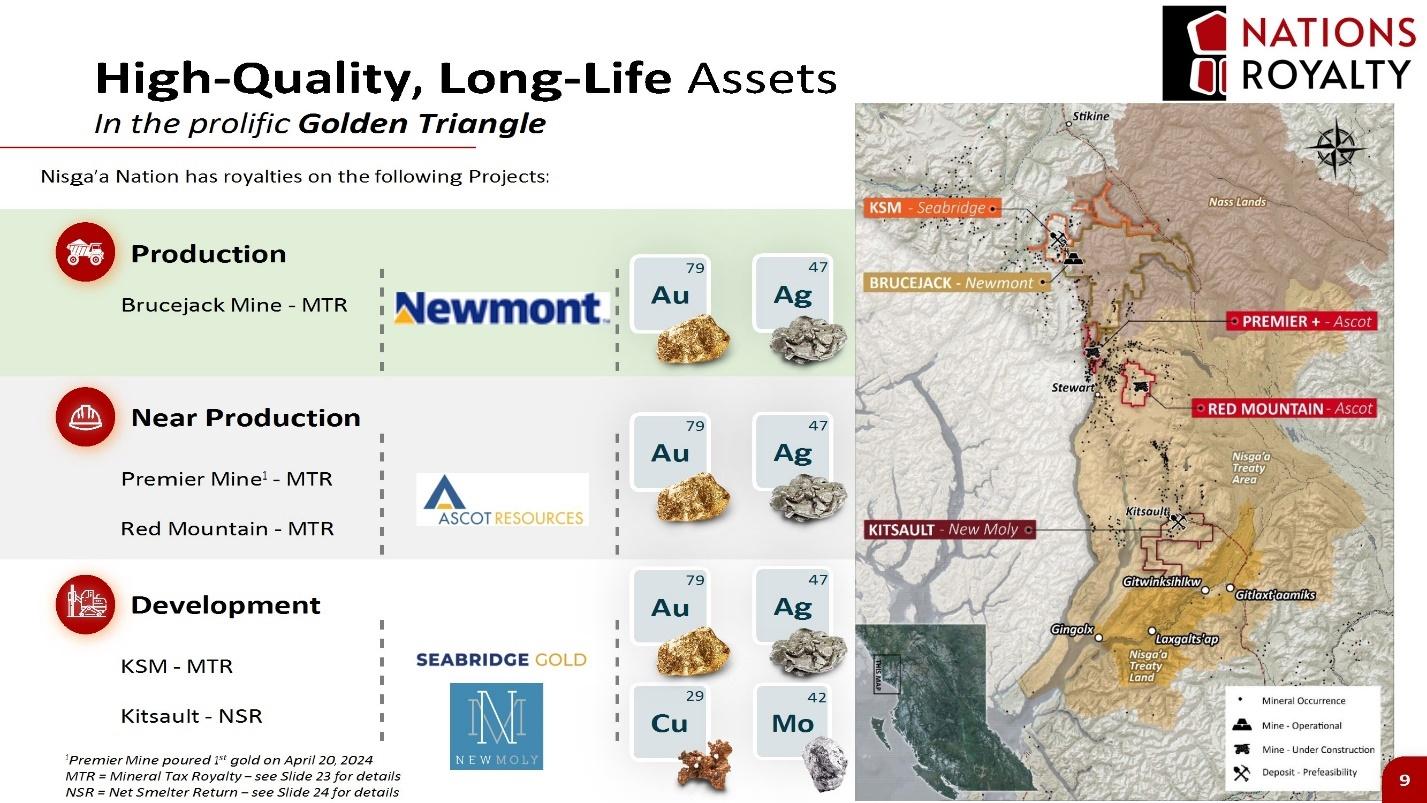

Nations Royalty’s foundation begins with five annual benefit payment entitlements in place, owned by the Nisga’a, in respect of the following properties in Canada:

-

The high-grade Brucejack gold mine operated by Pretium Resources Inc., a wholly-owned indirect subsidiary of Newmont Corporation, a large underground gold mine;

-

The KSM Copper-Gold-Silver-Molybdenum Deposit, currently in development by Seabridge Gold Inc.;

-

The Premier Gold Project, currently being commissioned by Ascot Resources Ltd. with first gold poured in April, 2024 and commercial production scheduled for Q3 2024;

-

The Red Mountain Gold Deposit, owned by Ascot Resources Ltd.; and

-

The Kitsault Molybdenum Deposit, a large, fully permitted brownfield site owned and being actively advanced by New Moly LLC, majority-owned by Resource Capital Fund VI L.P.

Resource investors are acclimatized to seeing “Social/Community” links on mining company websites boasting about warm relationships with local Indigenous groups.

Investors understand that weak ESG initiatives can kill resource projects. Conversely, strong local partnerships combined with robust environmental protections are significant de-riskers.

Twenty years ago, to a large extent, the “Social/Community” subplots were window dressing. That is no longer the case.

In 2024, resource projects operating on Indigenous Canadian territories are extremely unlikely to be green-lit without Indigenous consent.

“The United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) that was adopted in 2007 and given Royal Assent by the Government of Canada in 2021,” reports the Canadian Mining Journal.

“The result is the change from duty to consult to right to consent (Free, Prior and Informed Consent, FPIC). The key difference is that new projects now hinge on the rights of Indigenous Peoples to give or withhold their consent for any action that would affect their lands, territories, or rights.”

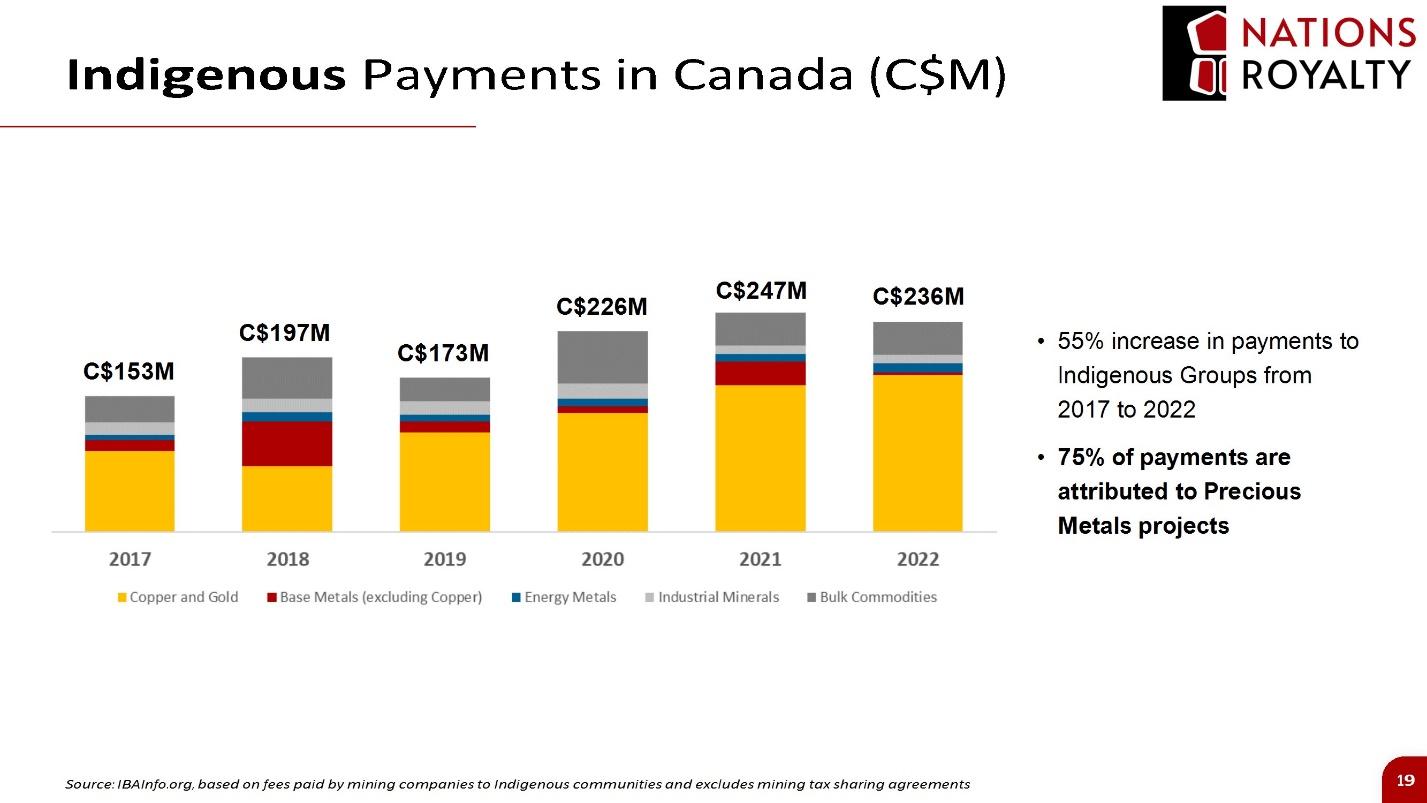

These legal and jurisdictional changes catalyse the growth opportunity for Nations Royalty. There are over 150 Indigenous royalty agreements across Canada in NRC’s database. In the last five years, there has been a 55% increase in those royalty payments to Indigenous groups.

On June 17, 2024 interim Nations Royalty CEO Rob McCleod was interviewed by Steve Hyland – Host of the Daily Dive.

Rob McLeod is a 3rd-generation miner with a track record in BC’s Golden Triangle. He founded Underworld Resources which sold to Kinross Gold for C$140 million, and developed IDM Mining which sold to Ascot Resources in 2019.

Rob’s father, Ian McLeod, was a close ally of Nisga’a leadership. Ian McLeod helped run election campaigns starting in 1949 for Dr. Frank Calder, the first Indigenous person to serve Public Elected office for any provincial legislature in Canada.

“I grew up in Nisga’a traditional territory, in the mining community of Stewart, BC,” McLeod told Hyland. “But I am a white man. The leadership of this company at all levels will be Indigenous. It’s a very important component of economic reconciliation – having Indigenous people in business leadership positions. Frank Giustra has been adamant about this.”

You could be forgiven for thinking, “There are no qualified indigenous applicants to helm a publicly traded mining company.” But we used to say the same thing about women.

Women now hold 11.1% of C-suite positions, according to an analysis by S&P Global Market Intelligence. That’s nothing to brag about. But it’s higher than zero.

“The truth is that the lack of opportunities and exclusionary organizational cultures breed barriers to entry for women,” Anglo American Platinum CEO Natascha Viljoen told Market Intelligence.

In Canada, the pool of senior Indigenous mining talent is not shallow. The quality of managers Nations Royalty has already recruited suggests that a future CEO could come from internal promotion.

On May 23, 2024 Derrick Pattenden was appointed as Nation Royalty’s Chief Investment Officer. A member of the Mohawks of the Bay of Quinte, he is a veteran investment banker, specializing in finance, mergers and acquisitions, having participated in M&A transactions with a combined equity value of over C$20 billion.

Pattenden has direct experience working on transactions involving mining royalties, as well as transactions that created royalty companies, or restructured existing metal streaming agreements.

“I left a fantastic job at Canaccord Genuity to join Nations Royalty,” Pattenden told Guy Bennett, CEO of Global Stocks News (GSN). “This is a project I am very passionate about.”

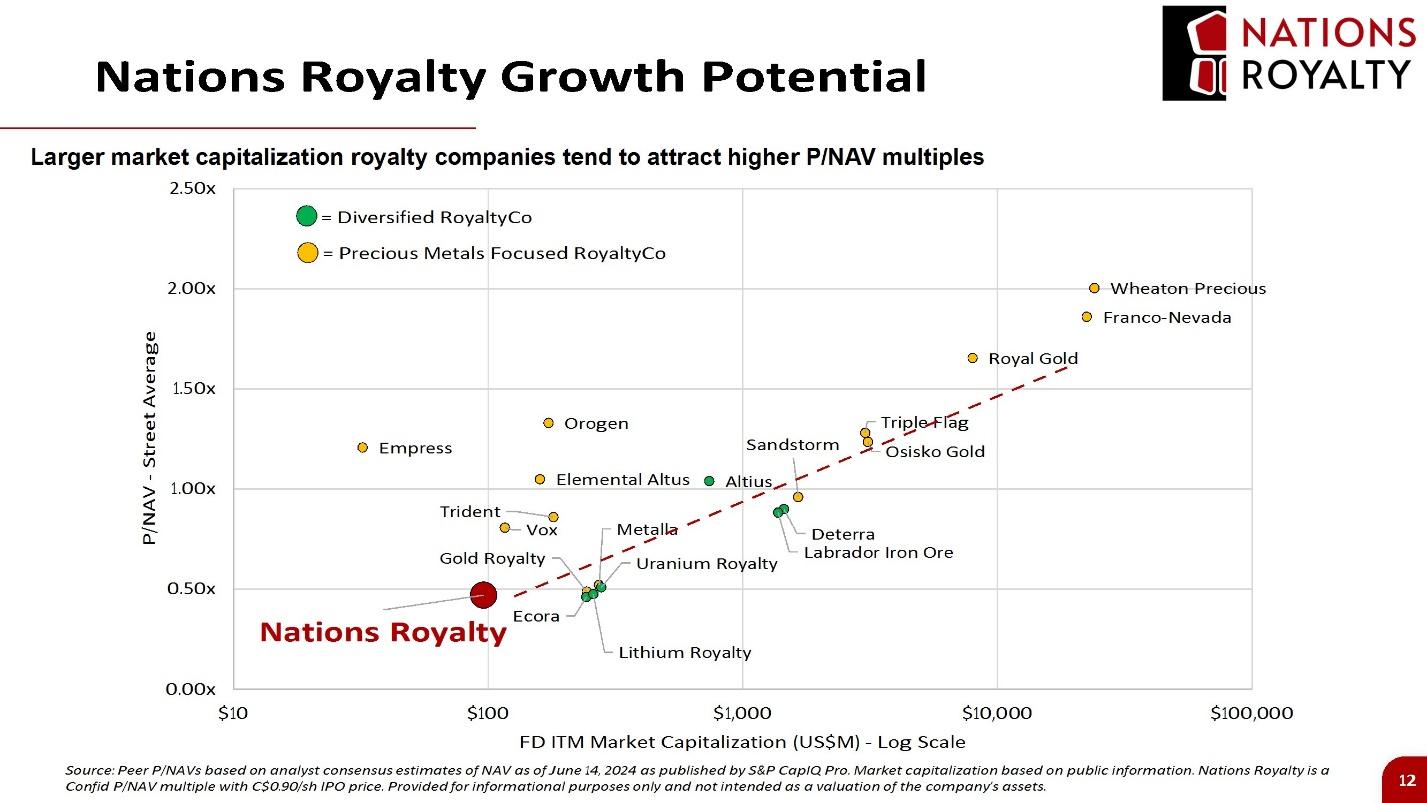

“The ‘Mining Royalty Model’ is already well established. Two of the Top Five largest gold mining companies in Canada are mining royalty companies. They don’t mine, they just collect cheques.”

“There are many different ways this model can evolve,” said Pattenden. “In the future, we may branch into the business of creating royalties. Helping Indigenous groups negotiate with mining companies for more meaningful participation.”

“Right now, we’re seeking Indigenous partners on existing Indigenous royalties. We have a powerful value-proposition to bring to the table. Our team has the connections and credibility in those communities to start conversations and create partnerships.”

“This is the last untapped opportunity set in the royalty space. The big guys and little guys compete with each other over royalties. Nations Royalty is in its own lane, being an Indigenous-controlled company focusing on Indigenous royalties,” added Pattenden. “An isolated mine royalty is valuable, but when it’s packaged together with other royalties, there is a multiplying effect.”

“That is our objective, to bring a galaxy of Indigenous royalties under one umbrella, creating wealth for the Indigenous royalty holders, and all NRC shareholders.”

On June 24, 2024 Kody Penner was appointed Nations Royalties Vice President of Corporate Development. A young Indigenous business leader, Penner was an underground miner at Newmont’s Brucejack Gold Mine. Listed at 6’6” Penner was drafted to play football (tight-end) for SFU, before promptly blowing out his right knee.

“I was born in Nelson, BC,” Penner told GSN. “My dad was an underground miner. For the first two years of my life, our family lived at the mine house. I’ve been in many underground mines. I spent 18 months working underground at Bruce Jack, working as a jack-leg miner, following in my father’s footsteps.”

Through talent, education, focus and drive, Penner emerged from the underground shafts and began climbing the corporate ladder. He is Vice-Chair of the Tahltan Nation Development Corporation. Before coming to Nations Royalty, Penner was Lead, Business Planner at Teck Resources Copper Growth Group.

GSN asked Penner how his background as a jack-leg miner informs his current corporate development role.

“Why do workers climb down into dirty holes to do a dangerous job?” Penner asked rhetorically. “They do it for their spouses and their children. To pay for food, clothing, dentistry and education. They see mining as a tool for advancement.”

“My experience underground has helped me understand the values of miners,” Penner continued. “I’m passionate about Nations Royalty because I’ve seen the positive impacts a mine can have in a remote area. Without those high paying jobs and royalties, it’s difficult to break cycles of poverty.”

“Indigenous people in Canada make almost three times more working in the oil and gas extraction sector than the average Indigenous worker ($140,400 vs $51,120 average employment income) and almost twice as much working in mining ($93,600),” reports the Indigenous Resource Network.

“About 10% of the mining workforce is Indigenous,” confirms Penner. “Any Indigenous group that owns a royalty is likely to have members working underground or in exploration. If Nations Royalty is doing due diligence on a mining asset, it’s important for us to understand the world view of stakeholders, and to have walked in their shoes.”

“Nisga’a have always been leaders,” stated Interim CEO Rob McLeod, “Now, they are the founders of the largest majority Indigenous-owned public company in Canada.”

“Royalty companies have been the crown jewel of the mining space over the past two decades,” concluded McLeod. “We have the first-mover advantage and look forward to nurturing indigenous talent while creating significant value for all investors in Nations Royalty.”

Disclaimer: Nations Royalty paid GSN CND $1,500 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com