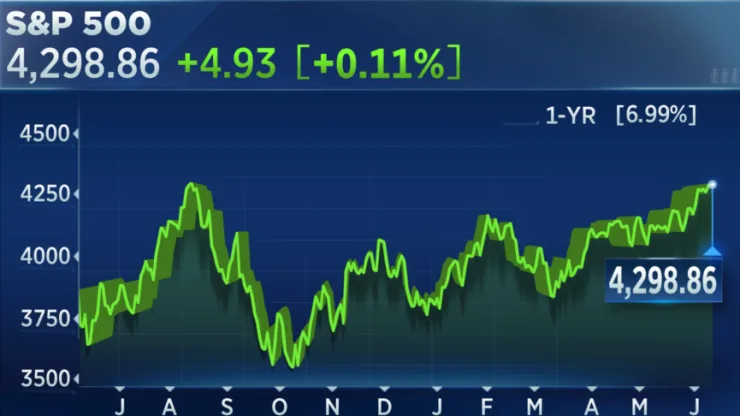

S&P 500 touches highest level since August 2022.

The S&P 500 rose slightly Friday, touching the 4,300 level for the first time since August 2022. The broad-market index gained 0.39% for the week closing at 4,298.86. The Nasdaq was up about 0.14%, posting its seventh straight winning week — its first streak of that length since November 2019. The Dow advanced 0.34%.

Tesla deal charges stock toward longest winning streak

Tesla (TSLA:NASDAQ) matched its longest winning streak of 11 straight days in the green after the EV stock closed positive on Friday. The last time the stock was up for so long was in January 2021. The streak follows Tesla’s Thursday announcement that General Motors (GM:NYSE) would join Ford (F:NYSE) in using its electric vehicle charging network to charge their cars.

Apple enters the world of virtual reality.

Apple (APPL:NASDAQ) on Monday unveiled its first major new product in nearly a decade, the Vision Pro headset. The device allows users to experience virtual reality and any content available on a computer monitor overlaid on the real world.

Apple said the device, which will sell for $3,499 and won’t be available until early next year, would be a new way to interact with digital content in the physical space using the user’s hands, eyes and voice to interact with apps. Users can control the device with their hands and experience movies, TV shows and games in a more immersive way.

Adobe upgraded by Wells Fargo

Adobe (ADBE:NASDAQ) shares rose more than 3% on Friday trading after Wells Fargo (WFC:NYSE) said artificial intelligence should boost the stock. Analyst Michael Turrin upgraded the software stock to overweight from equal weight and raised his price target to $525 from $420. Turrin’s new target implies a 19.6% upside from where the stock closed Thursday.

“The AI debate continues to drive ADBE,” he said in a note to clients Friday. “We come away from recent work more confident Gen AI is a tailwind to ADBE as we expect much of the early value to accrue to established platforms & see potential for further break-out as products are monetized.”

Citi downgrades Target

Target (TGT:NYSE) declined about 3.3% after Citi (C:NYSE) downgraded the retail stock to neutral from buy, saying sales may have peaked at the big-box merchandiser.

Analyst Paul Lejuez dcut his price target to $130 from $177, with his new target implying the stock will fall nearly 1% in the next year from where shares finished Thursday. He said the company’s recent sales data is concerning and could show a peak.

Netflix subscription numbers increase on heels of password sharing crackdown

Netflix’s (NFLX:NASDAQ) crackdown on password sharing is in its early days in the U.S., but it appears to be having the effect the streamer was looking for – a boost to its subscriber base.

Since alerting its members in late May of its new password-sharing policy, Netflix had its four single-largest days of signing up U.S. customers since data provider Antenna began tracking the service.

Average daily signups to Netflix reached 73,000, a 102% increase from the prior 60-day average, which surpassed the spike in sign-ups during the initial lockdowns of the pandemic, according to Antenna.

The game stops for GameStop’s CEO.

The videogame retailer’s shares plummeted following Wednesday’s announcement that GameStop (GME:NYSE) fired Chief Executive Matt Furlong—without giving a reason—and elevated Ryan Cohen to executive chairman. GameStop also posted disappointing quarterly earnings.

The ousting comes around two years after Mr. Furlong was hired as part of a push for GameStop to move faster into e-commerce. Furlong came from Amazon, while Cohen co-founded the online pet-supply retailer Chewy. Cohen was elected chairman of GameStop in 2021 after building up an activist stake in the company.

GameStop shares plunged 18% Thursday, its largest percentage decrease since mid-2021, the year GameStop became a meme stock.