Sponsored content disseminated on behalf of Dolly Varden Silver. On September 9, 2024 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) (FSE: DVQ1) announced results from the Wolf Vein high-grade silver plunge expansion directional drilling.

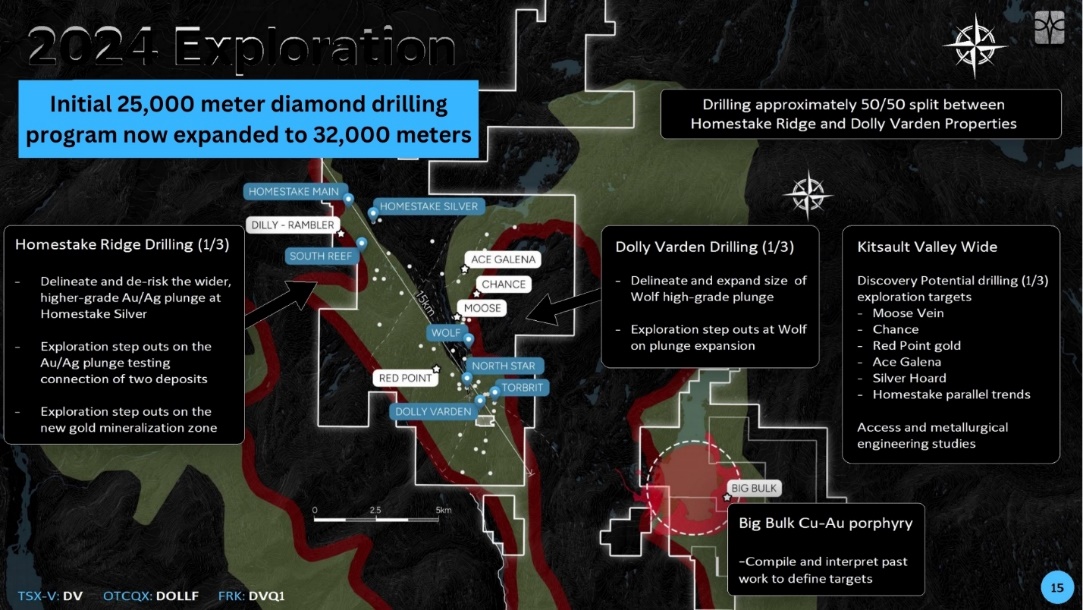

Dolly Varden Silver is advancing its 100% held Kitsault Valley Project, located in the Golden Triangle of British Columbia, Canada. The 163 sq. km. project hosts high-grade silver and gold resources. 5 km to the east, the recently consolidated Big Bulk project is prospective for porphyry and skarn-style copper and gold mineralization.

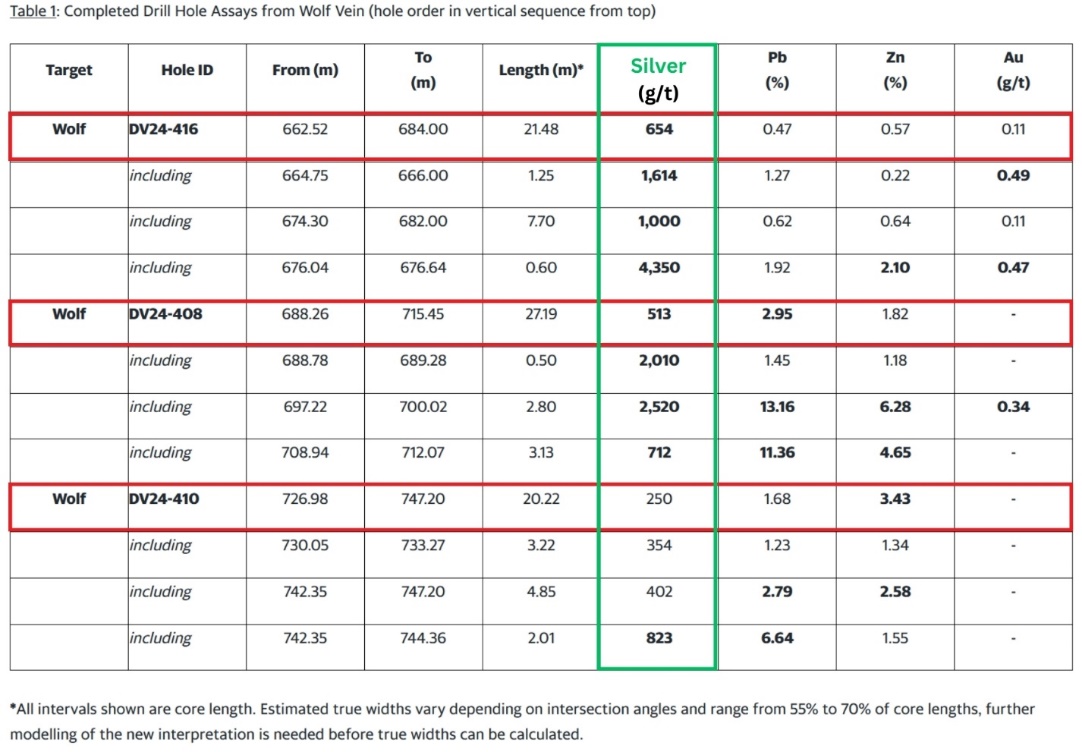

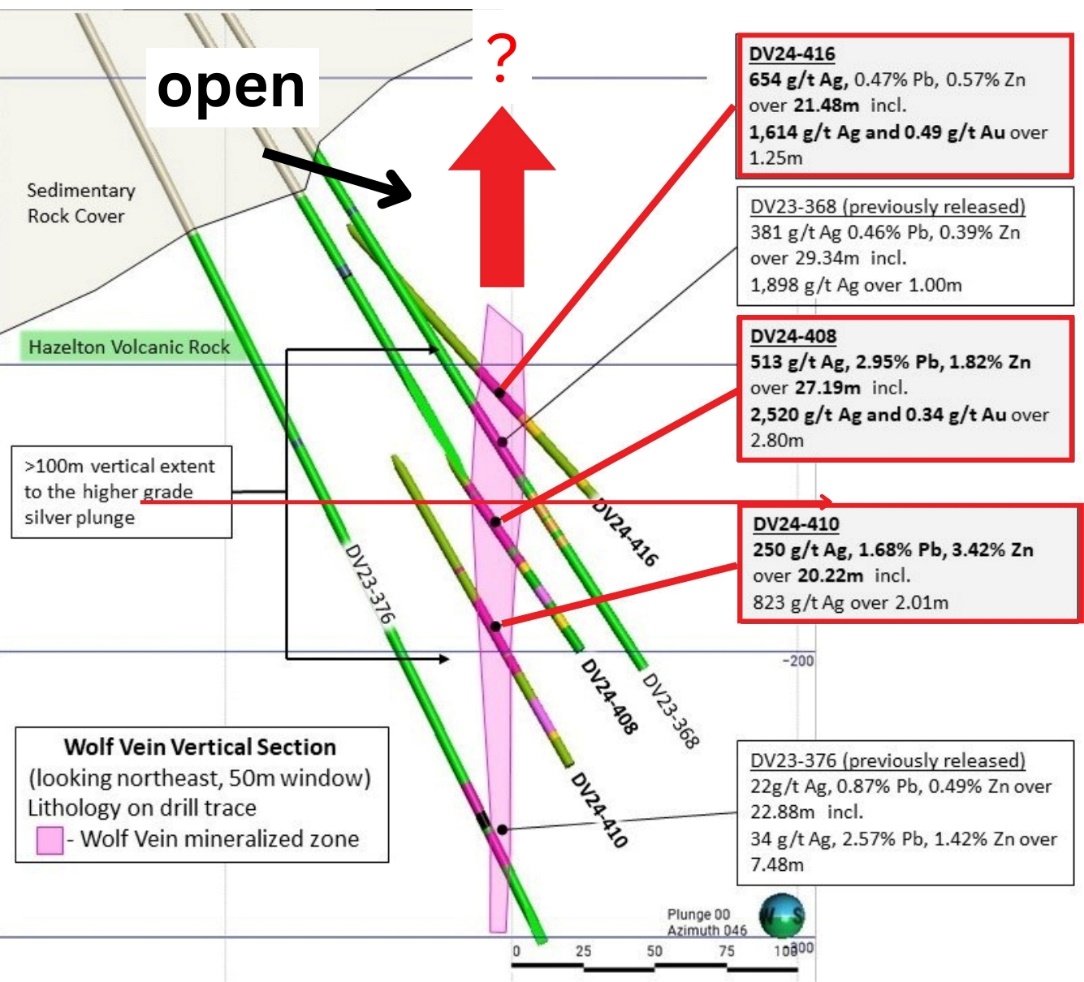

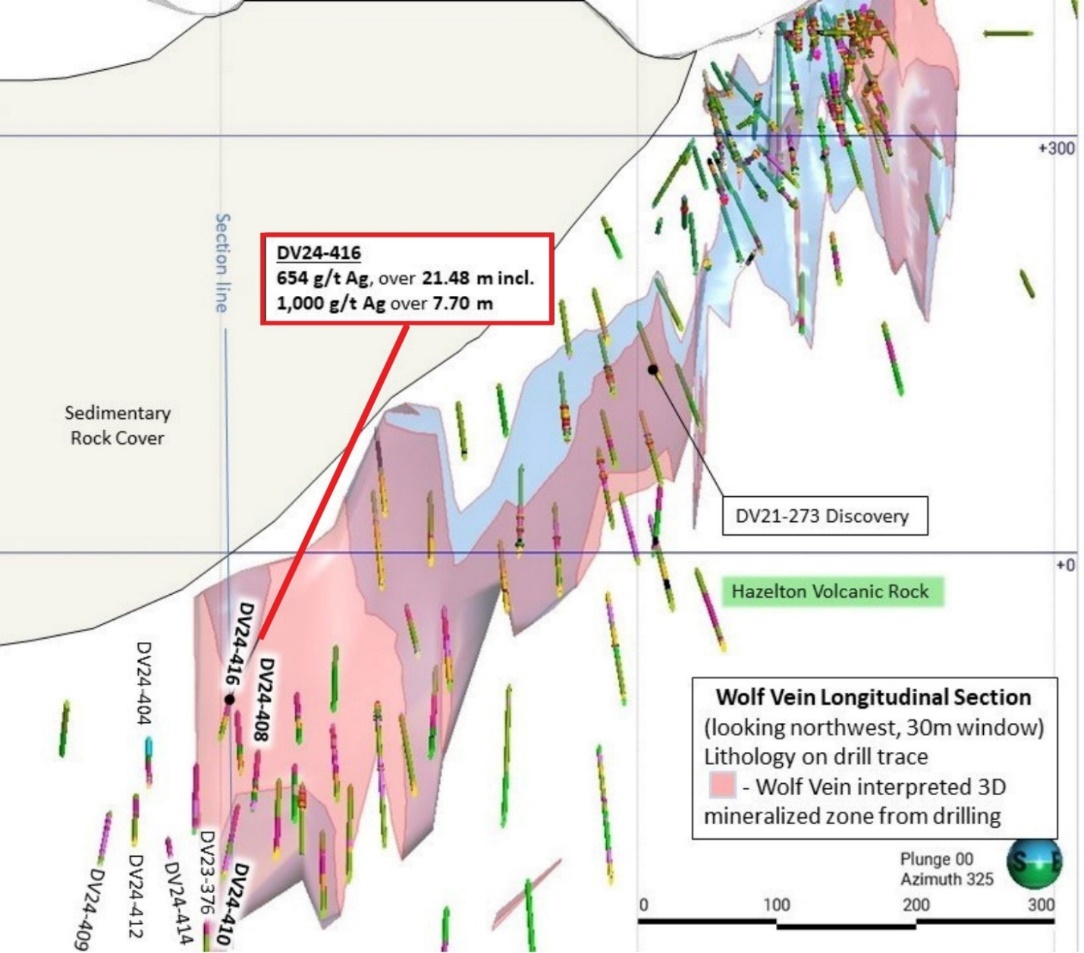

Drill hole DV24-416, averaged 654 g/t Ag, 0.47% Pb and 0.57% Zn over 21.48 meters and drill hole DV24-408, averaged 513g/t Ag, 2.95% Pb and 1.82% Zn over 27.19 meters.

Holes DV24-416 and DV24-408 are located on the same vertical section and are separated by 44 meters vertically.

The intersections demonstrate consistent thicknesses and indicate an increased vertical extent to the mineralized zone as it plunges to the southwest.

The 2024 exploration drill program on the Kitsault Valley Project has been expanded from 25,000 meters to 32,000 meters.

Three drills continue expansion drilling at the Homestake Silver Deposit.

“The Wolf Vein continues to deliver exceptional silver grades, often with significant base metal values and strong native silver mineralization over potentially bulk-mineable widths,” stated Shawn Khunkhun, CEO of Dolly Varden Silver.

Lower cost bulk underground mining methods would allow for a lower cut off grade which would increase the tonnage.

“The extended drill program will prioritize lateral and vertical step-outs from these new Wolf results and follow up at other exploration targets including the silver zone at Moose,” added Khunkhun.

“Resource expansion and exploration drilling efforts at the Homestake Silver Deposit continues within the projection of wider higher-grade gold and silver plunge zone defined in 2023.”

The September 9, 2024 release includes results for three directional drill holes drilled from the same pad and intersecting the Wolf Vein on the same section. The mineralized vein remains open towards the sediment cap above it.

Step out drilling along the upper portion of the plunge has been prioritized for late season.

The breakthrough discovery at the Wolf Deposit was catalyzed by the youngest DV Silver geologist, Amanda Bennett, who cut her teeth at Hudbay Minerals and White Gold.

When Bennett joined DV in March of 2021 she was asked to review the historical data and identify promising new drill targets.

“Amanda zeroed in on the Wolf Deposit as an area of interest,” recalled Khunkhun. “Our VP of Exploration Rob Van Egmond looked at her model and said, ‘Let’s give it a try’”.

In 2021, Dolly Varden released the first results from Bennett’s Wolf program, hitting 1,532 g/t Ag over 1.22 meters core length.

In 2022 DV intersected 584 g/t Ag over 19.85 meters (13.90m true width)

In 2023 DV hit1,499 g/t over 15.94 meters (8.77 meters estimated true width).

In August 2024, a 40-meter southwest Wolf Vein step-out intersected 1,091 g/t silver over 9.38 meters.

In September, 2024, drill hole DV24-416, averaged 654 g/t silver over 21.48 meters.

DV’s precious metal inventory has increased 300% in the last four years through acquisition. Exploration drilling done after 2019 will be added in on the next property wide mineral resource estimate.

Key Highlights of 2024 Drilling Program:

-

Three drill rigs mobilised

-

Initial 25,000 meter drilling expanded to 32,000 meters

-

Focus on Homestake Silver and Wolf Deposits

-

Follow up on new discoveries

On September 6, 2024, Khunkhun talked to HTZ Cap about the demand drivers for silver.

“In the last 100 years, 98% of the time we’ve been in a bear market,” Khunkhun told HTZ Cap. “And during those bear markets, 30% of the silver has been purchased by investors.”

“We are unequivocally in a bull market for gold,” Khunkhun continued. “It’s hitting record highs in all currencies. Historically, silver outperforms gold in precious metal bull markets. By the end of 2025 – 16 months from now – it is projected that industry will consume all of mined silver.”

“Demand for silver from the makers of solar PV panels, particularly those in China, is forecast to increase by almost 170% by 2030, to roughly 273 million ounces—or about one-fifth of total silver demand,” reports the Wall Street Journal.

“The 850 million ounces that we mine on an annual basis, is going to get 100% consumed by the growing industrial demand for silver,” confirmed Khunkhun. “In the last three years, we’ve had 250-million-ounce deficits for silver. Investment demand will come. I believe we’re setting up for the greatest squeeze in the history of silver.”

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN CND $1,500 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. Our publications should be used as a starting point for additional research and “due diligence”. GSN publications contain “forward-looking statements” such as “may,” “anticipate,” “expect,” “project,” “intend,” “plan,” “believe,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.