Vancouver, BC – November 7, 2024 – Sponsored content disseminated on behalf of Dolly Varden Silver. On November 4, 2024 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) (FSE: DVQ1) announced drill results from its 2024 program at the Homestake Silver deposit in BC’s Golden Triangle.

Dolly Varden Silver is advancing its 100% held Kitsault Valley Project, located in the Golden Triangle of British Columbia, Canada. The 163 sq. km. project hosts high-grade silver and gold resources. 5 km to the east, the recently consolidated Big Bulk project is prospective for porphyry and skarn-style copper and gold mineralization.

“The five holes we reported on November 4, 2024 are technically infill holes,” Rob van Egmond, DV’s VP of Exploration told Guy Bennett, the CEO of Global Stocks News (GSN). “Although that area had fairly sparse drilling. We knew the area was mineralized, but we wanted to know more about the structure of the deposit.”

The wide intercepts of high-grade gold are putting Dolly Varden’s “silver pure play” status in jeopardy. This creates a messaging challenge for DV’s marketing professionals, but it is offset by potentially improved mine economics. GSN asked van Egmond if the presence of gold in a silver zone complicates the metallurgy.

“Gold-Silver projects are common,” stated van Egmond. “When you are processing gold-silver bearing rocks, you will typically sacrifice the recovery of one metal to optimize the recovery of the other. Given that gold ($2,600/ounce) is worth about 80 X more than silver ($31/ounce) by weight, we anticipate calibrating the extraction to favour gold in the case of the gold dominant deposits at Homestake Ridge, and optimize for Silver on the southern silver deposits.”

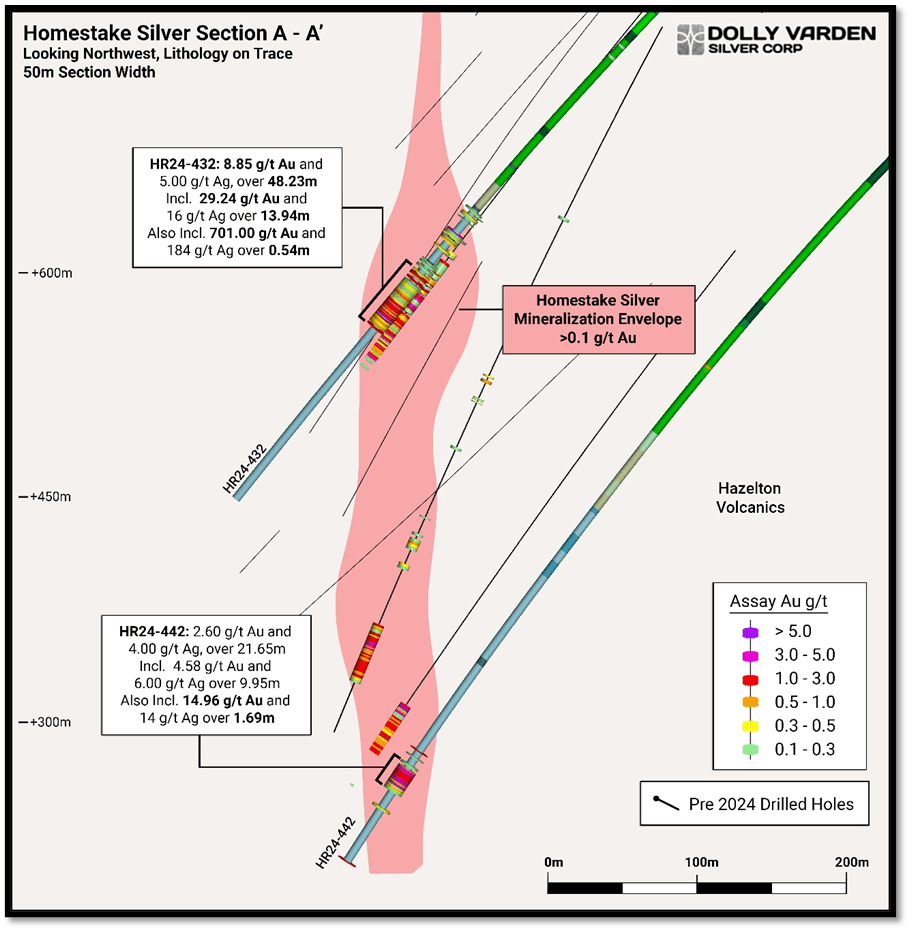

“We were surprised how good these results were,” continued van Egmond. “We had an internal zone grading 29.24 g/t gold over 13.94 meters. We reported that also as 8.85 g/t gold over 48.23 meters. This accurately reflects the potential low cost, bulk underground mining method that could be utilized for Homestake Silver.”

Bulk mining generally has lower associated mining costs, allowing for a lower cut-off grade bringing in more material, increasing the tonnage per day and the number of ounces mined.

“Some of these old, narrow vein deposits don’t work in the modern era,” Shawn Khunkhun confirmed to GSN. “You don’t want to be chasing narrow veins, hand sorting material. Our goal is that Dolly Varden Silver will create an efficient, highly mechanized mine with a low All-In-Sustaining-Cost (AISC).”

On November 6, 2024, DV silver released a video by van Egmond, giving further context to the drill results.

“Last year, we drilled a few holes that indicated there was a high-grade plunge. These latest holes confirmed that theory to us. The results are over a wider distance and a lot better than we anticipated.”

“The gold component now makes up half of our precious metals valuation,” continued van Egmond. “It’s very significant, it’s a very large system. Next season, we’re fully funded, and it looks like half of our meters will go to Homestake again.”

The November 4, 2024 results confirm that Homestake Silver contains a substantial zone of exceptional precious metal grades, typified by multiple phases of silver and gold mineralization, over wide, continuous intervals that are potentially amendable to bulk underground mining methods.

With 69 drill holes completed for a total of 31,726 meters, the 2024 Kitsault Valley Project drill program is finished for the season.

“It’s not practical to drill in the winter this far north,” van Egmond told GSN. “You get snow at higher elevations, and there are not enough daylight hours. We’re helicopter supported. The helicopter can only fly from 30 minutes after dawn to 30 minutes before dusk. By mid-September the night shift becomes 14 hours.”

“The drill crew sleeps in Alice Arm,” explained van Egmond. “We have two people per rig. Three drills turning, so that’s six people flying in and out. We keep the crew comfortable and feed them well. It’s not something most investors think about, but the quality of food in remote locations is an important part of corporate culture. During drilling season, the cooks are the first people the crew see after they wake up. A well-fed crew is happier and more productive than one that is fed peanut butter on crackers. As word gets around in the exploration community, it helps you recruit the best people.”

“The identification of a gold-rich, wide and high-grade area within the Homestake Silver Deposit is highly encouraging,” stated Khunkhun, “Our geological team is encouraged by overlapping mineralizing phases of silver and gold rich veins and breccias; the deposit remains open for expansion.”

Figure 6. Homestake Silver Cross Section (A-A’) with 2024 and previous drill holes. *Estimated true widths vary depending on intersection angles and range from 70% to 85% of core lengths.

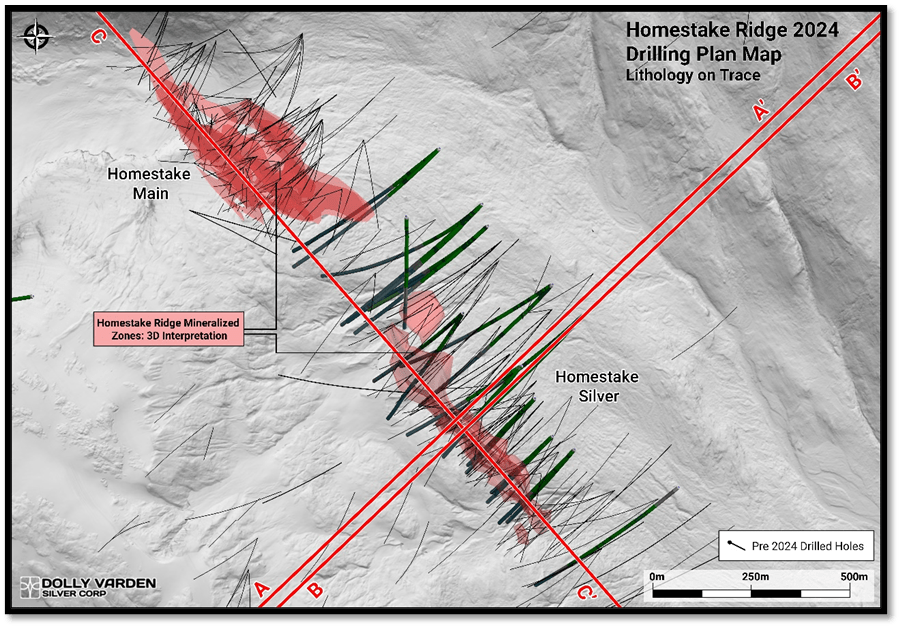

Results from the five holes in the November 4, 2024 release suggest that the plunge of mineralization at Homestake Silver has a similar orientation as the Homestake Main Deposit, located 300m to the northwest. The average grades within these core areas are higher, on a precious metal silver equivalent basis, than the average grade of the silver deposits at the Dolly Varden property further south, due to the increased gold content at the Homestake Ridge Deposits.

This season, 41 holes totaling 15,5467 meters were drilled at the Dolly Varden area and 28 holes totaling 16,181 meters were drilled at Homestake Ridge.

Results are pending on an additional 23 drill holes from Homestake Silver and property wide exploration drilling.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,500 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. Our publications should be used as a starting point for additional research and “due diligence”. GSN publications contain “forward-looking statements” such as “may,” “anticipate,” “expect,” “project,” “intend,” “plan,” “believe,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.