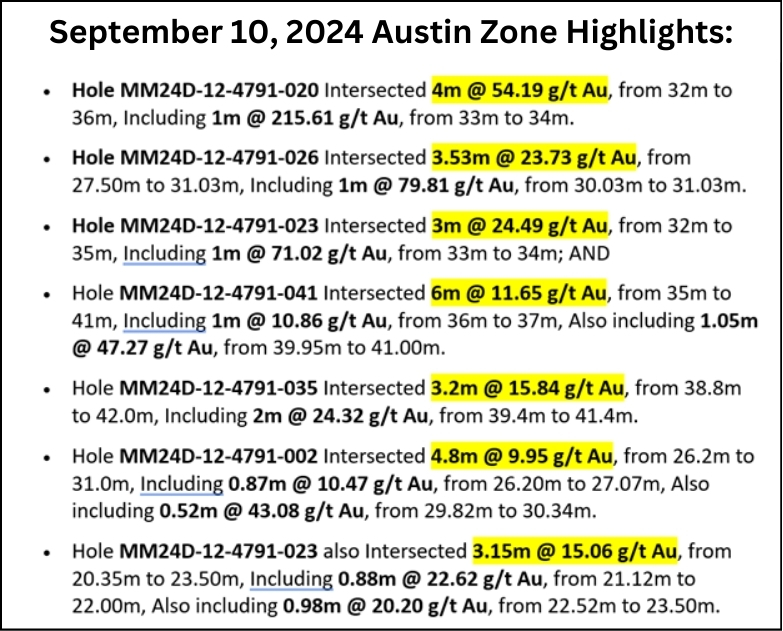

Sponsored content disseminated on behalf of West Red Lake Gold. On September 10, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF reported drill results from the high-grade Austin Zone, at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

The Austin Zone currently contains an Indicated mineral resource of 914,200 ounces, grading 6.9 grams per tonne gold, with an additional Inferred resource of 104,900 oz grading 6.5 g/t gold.

The Austin definition drilling is targeting priority areas to continue building an inventory of high-confidence ounces supporting the restart of production at the Madsen mine, which is targeted to begin in H2 2025.

WRLG expects to complete a pre-feasibility study (PFS) in support of that restart goal in the coming months.

“The Madsen Mine PFS has a strong foundation of known variables, because Madsen is already largely built,” Shane Williams, WRLG President & CEO told Guy Bennett, the CEO of Global Stocks News.

“Typically, a PFS makes projections about geo-tech, metallurgy, mining methods, and process choices,” Williams continued. “Because Madsen was in operation recently, we have deep data on many of these factors, so the critical cost inputs for the PFS are actual, not estimated.”

The PFS will outline the mine plan, including information on the operation’s expected scale, costs, and timelines. WRLG has been preparing for this study since acquiring the project in 2023; infill drilling to inform a confident resource model has been a large part of the work.

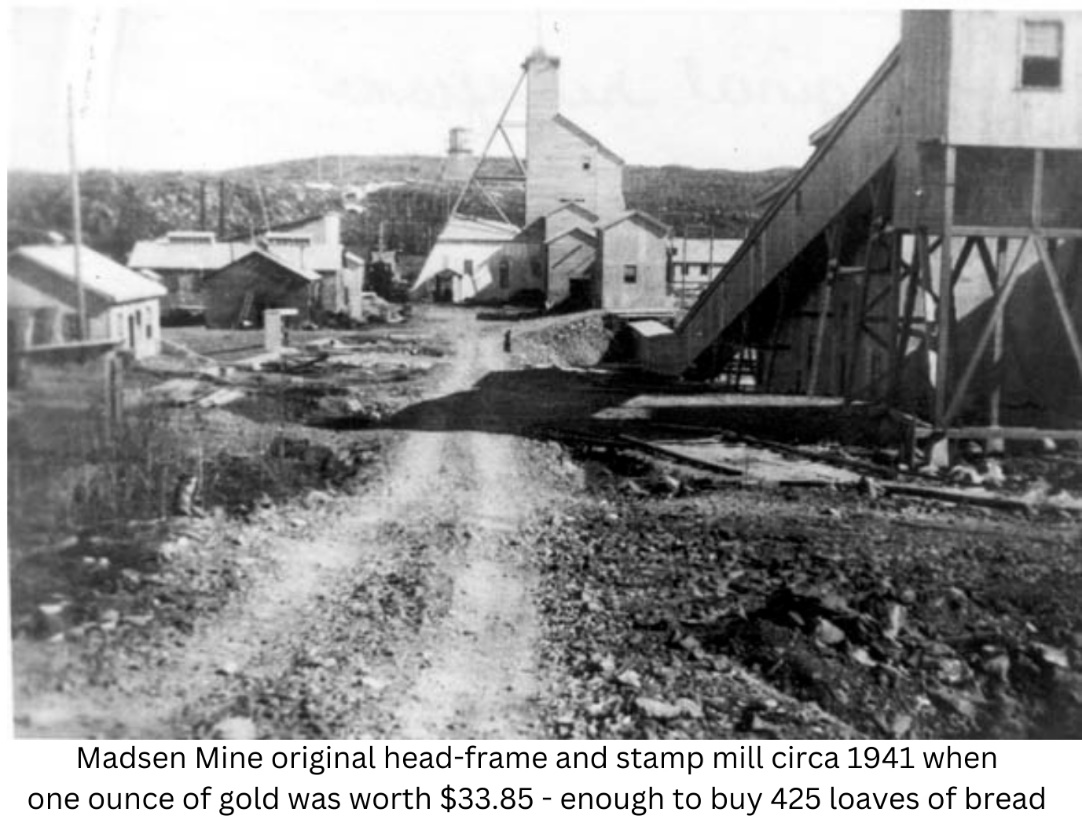

“Due to limited underground development, the two previous operators were only able to access portions of the Madsen deposit down to around 9 level,” stated Williams.

“We are very excited to continue accessing deeper portions of the deposit which were historically mined during a period when gold was only valued at $20-40 per ounce.”

“This resulted in very selective mining practices targeting the core of the system that left behind a lot of mineralization that would be considered high grade by current standards.”

“With gold prices now in excess of US $2,500/oz we are taking full advantage of that remnant material and see a lot of upside at depth in Madsen,” concluded Williams.

To see the drill holes reported September 10, 2024 in the context of a 3-dimensional model of the Madsen project mineral resource, click here.

Since acquiring the Madsen Mine project last year, the WRLG has completed a site-wide operational assessment to make informed decisions about what surface and underground upgrades would underpin a sustainable mining operation.

“I have led teams through many mine builds and each build reinforced the lesson that operational readiness is essential to a successful mine startup,” stated Williams.

On September 04, 2024 WRLG provided an update on activities at the Madsen Mine as it advances towards its goal of a targeted restart in 2025.

1. Drilling definition holes in the Austin, South Austin and McVeigh resource areas since October 2023.

2. A tailings dam lift project got underway in early August. Increasing the dam height by 4 metres will create enough additional tailings capacity for 10 years of operation, assuming a milling rate of 800 tonnes per day.

3. The Connection Drift is a 1,200-metre haulage way being driven to connect the East and West ramps of the underground mine at Madsen. These ramps, with independent portals, were not previously connected, resulting in substantial inefficiencies in moving mined material to the mill.

4. Dewatering of the Madsen Mine is a critical long-term objective because WRLG wants to create the option to mine deeper, to access known and potential mineralization.

5. Delivery of a primary crusher is expected in October, 2024. This will reduce rock from 19.6-inch feed size to 4-inch or less. The crusher can process 145 tonnes of rock per hour. The mill at the Madsen Mine has a nameplate capacity of 800 tonnes per day.

6. Test mining is now underway. The program has two goals: to inform safe and effective mine planning and to produce bulk samples for reconciliation calculations.

7. Mining equipment continues to arrive on site to support underground development, test mining, and the Connection Drift, and in anticipation of equipment needs upon a restart decision being made.

8. West Red Lake has partnered with Horizon North to provide 114-person accommodations and mine dry facilities for the Madsen mine site. These facilities are targeted for operation in February 2025.

Above: An electric primary jaw crusher plant similar to the one West Red Lake Gold procured for the Madsen Mine.

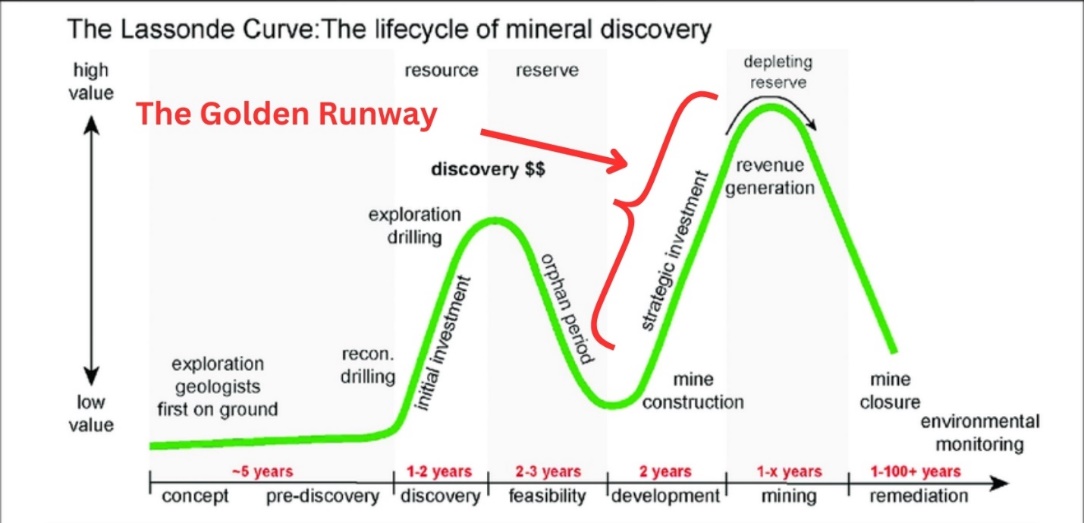

On August 11, 2024 Gwen Preston, VP of Investor Relations, explained in a 10X Capital video the significance of the Lassonde Curve and why “The Golden Runway” – the period from construction-decision to first gold pour – has an attractive risk/reward ratio for investors.

“After the drudgery of all that engineering and permitting, it’s time to actually build a mine,” stated Preston. “As you transition from breaking ground to producing gold, you go from a company that’s spending lots of money to a company that’s producing gold.”

“That is The Golden Runway. Ninety-two percent of companies that reach a construction decision achieve production. The odds and the returns that you get on that second ascent can be phenomenal.”

“West Red Lake Gold is at the beginning of The Golden Runway,” continued Preston. “The Madsen Mine Project in Ontario sits on top of a high-grade resource. A lot of the mine is already built. The mill is there. The underground development is there. The tailings facility is there. This thing is largely built. It’s an accelerated golden runway, because our targeted timeline to production is short.”

The Madsen Gold Mine is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 CND for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain “forward-looking statements” such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca