In a press release dated June 13, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) reported that a gold bar was poured using the refinery in the Madsen mill.

This event did not signal the official beginning of gold production at the Madsen Mine. That is now projected to happen in the second half of 2025.

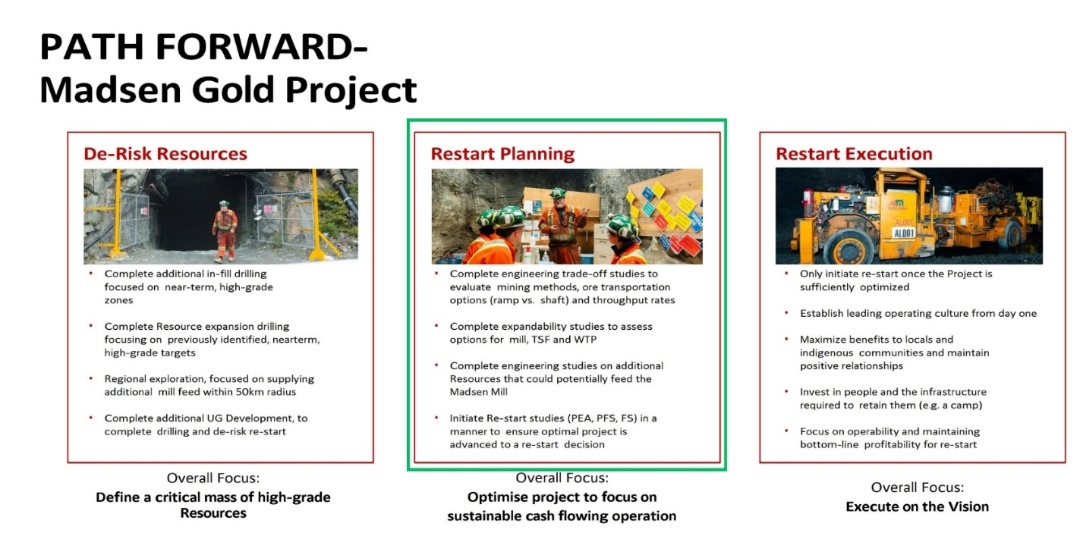

“We know what needs to be procured, built, and developed at the mine site over the next six to twelve months to achieve our goal of restarting the mine in 2025,” stated Shane Williams, WRLG President & CEO.

WRLG is working on a pre-feasibility study detailing that restart plan, which is targeted for release in early 2025.

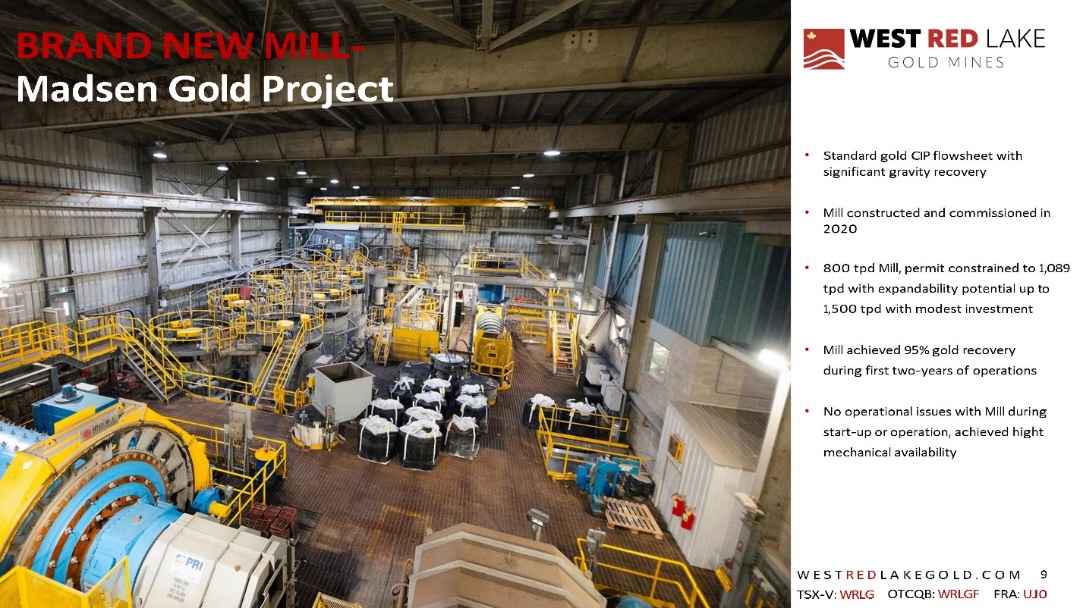

The gold pour is related to a mill cleanup program late in 2023 that recovered 415 troy ounces of gold with proceeds of approximately US$750,000 from material trapped in the mill’s circuits.

This prompted a second phase focused on the ball mills and semi-autogenous grinding (SAG) mills. Gold was found physically trapped in ill-fitting liners in the ball mill, in the SAG mills, and in uncleaned filters.

“Gold losses can happen in all kinds of ways,” Maurice Mostert, WRLG VP of Technical Services told Guy Bennett, the CEO of Global Stocks News. “From wind blowing ore dust off the tops of mine haul trucks to ore falling out when dumped and reloaded in transit, to mill traps and poor recoveries. Failing to fix these problems can create major problems for an operating mine.”

“The previous operators only ran the mill for a short time before shutting down. They did not have the opportunity to optimize the mill process or sort out the gold traps. We realized that we could capitalize on those inefficiencies. Our objective was to capture the value of the gold and to better understand the traps and how to fix them,” added Mostert.

“It is very exciting to be pouring gold again at the Madsen Mill,” said Williams, in the June 13, 2024 press release.

“Recovering trapped gold is another validation of the opportunity that’s available for us to unlock at the Madsen Mine,” added Williams. “With gold worth approximately US$2,300 per ounce, recovering these ounces from the mill will help bolster our treasury. And the excitement of pouring gold again at the mine is further energizing our team as we push to get Madsen back into production in the second half of 2025.”

In the following video, Gwen Preston, VP of Investor Relations at West Red Lake Gold, gives Crux Investor a clear summary of the previous operator’s mistakes and an update on current initiatives at the Madsen Mine Project.

“The previous operator decided to start mining in an area that they didn’t understand particularly well,” Preston told Crux Investor. “The drill holes were spaced 15 meters apart. That might seem close, but when you’re working in a high grade, narrow vein system, like Madsen, you need six to eight-meter spacing.”

“When you have relatively widely spaced drill holes, you run the risk of not knowing how the gold is distributed. You add on to that a lack of operating expertise – they chose a mining method that wasn’t appropriate. That resulted in excess dilution, which means they were mining non-mineralized rock”.

“You take a poorly understood system, implement an inappropriate mining method, that’s how you end up taking material to the mill that grades 3-4 grams/tonne gold, instead of the 7 grams/tonne gold that the feasibility study had anticipated.”

Prior to the mine restart, “the idea is to have a year’s worth of defined stopes,” stated Preston.

Stoping is a method of extracting ore from an underground mine that leaves behind an open space.

“Well-designed stopes are vital for the underground mining industry and are commonly used in large-scale mining,” states An Underground Miner. “Stoping methods can be used when the rock is strong enough to support the stope design.”

“It’s about planning out a year’s worth of mining, stope by stope exactly what that mine plan would be,” continued Preston. “That work is underway. We’re planning on doing another 50,000 meters of drilling over the next year. About a third of that will be on exploration, the rest of it is on making sure we know where the gold is.”

Photograph of gold recovered during the mill cleanup program being poured into a gold bar in the Madsen mill refinery on June 8, 2024.

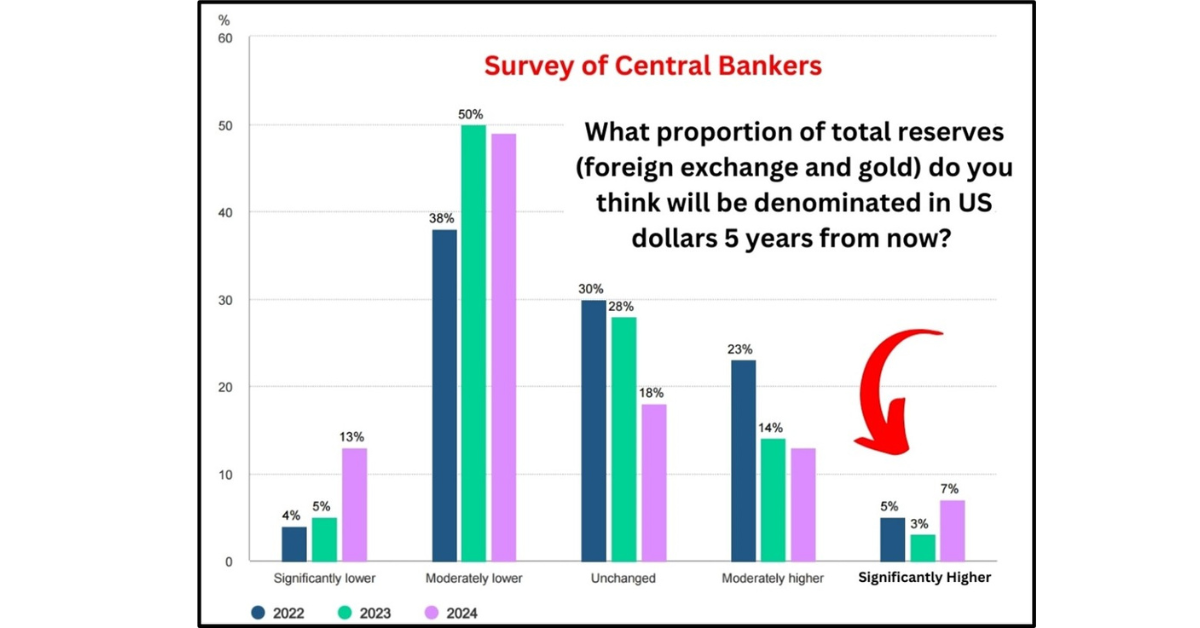

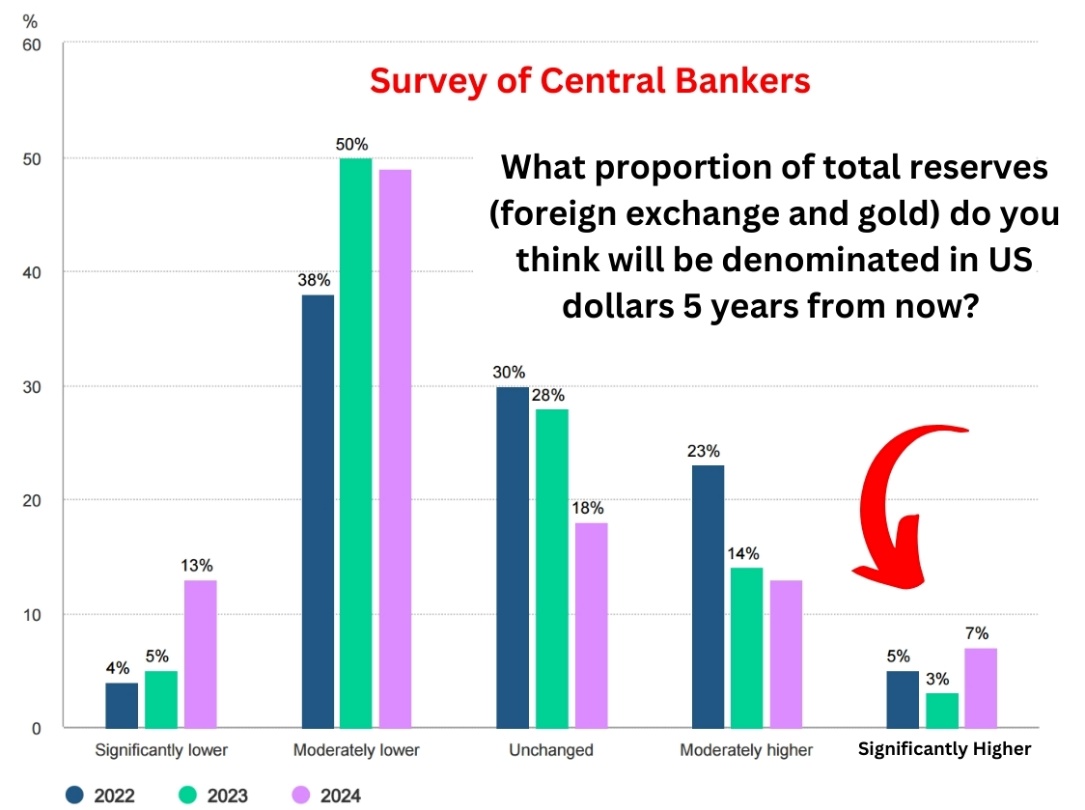

“In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022,” reports the World Gold Council on June 18, 2024.

According to a Q1, 2024 Central Banker Survey, “29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018.”

Central bankers are predicting a decline in the dominance of the US dollar, which is bullish for gold and echoes the long-held views of WRLG major shareholder Frank Giustra.

“With over 100 employees at site, constant underground development and drilling, and multiple capital projects underway or in planning, we are establishing the systems that support smooth mine operations,” stated Williams in the June 13, 2024 press release.

“We have $50 million in the bank right now,” concluded Preston in the Crux Investor interview. “Which is more than we need for the drilling.”

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid GSN $1,500 CND for the research, writing and dissemination of this content.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca