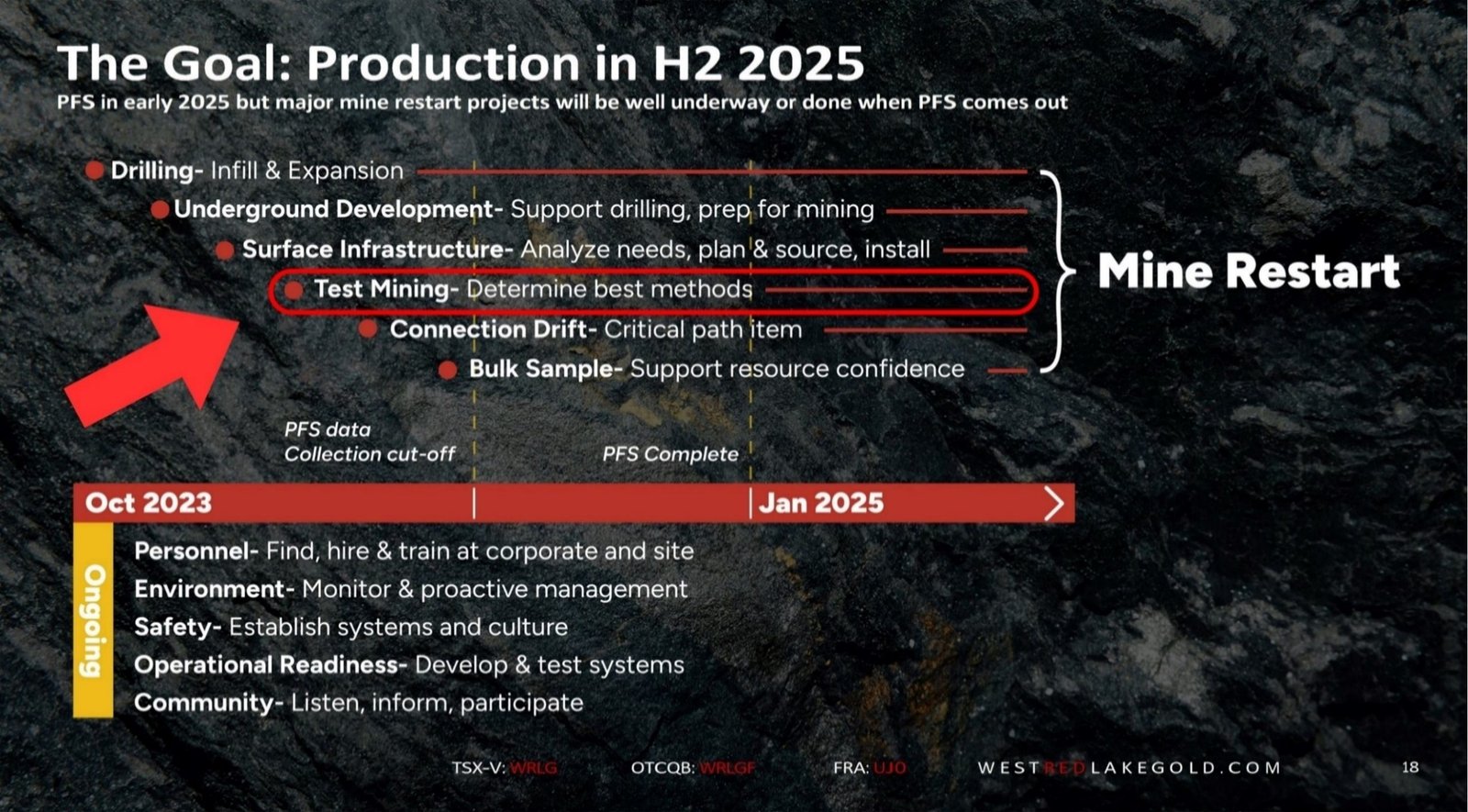

Sponsored content disseminated on behalf of West Red Lake Gold. On September 19, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported a 4-month test mining and bulk sample program is underway at the Madsen Mine, supporting the restart of production, targeted to begin in 2025.

“Test mining is an important part of our preparation,” Maurice Mostert, V.P. of Technical Services told Guy Bennett, the CEO of Global Stocks News (GSN). “The gold veins at Madsen are almost vertical. They undulate along strike, within the mineralized zone.”

“The test mining will give us a lot of information which will help to reduce dilution and increase operational efficiencies,” Mostert added. “To a large extent the geological drilling has determined where the gold is. We are reconciling the geological data with the physical mining process.”

“Data and experience are invaluable in mining. Test mining will provide data on how best to mine at Madsen,” confirmed Shane Williams, President and CEO of West Red Lake Gold.

“Bulk samples will allow us to compare modeled and actual mine resources, and the process will give our team another layer of operational experience.”

The test mining and bulk sample program has three goals:

-

To understand, prior to restart, the best methods to mine safely and efficiently in the various underground environments at Madsen.

-

To inform mineability decisions for mineralization near old stopes. Historic stopes are currently wrapped in 2-metre, null-resource buffers that could potentially be reduced or removed if trial mining demonstrates these buffer areas are mineable. This represents potential upside to the overall mineable inventory.

-

To create bulk samples that WRLG can batch process on mill startup to complete reconciliation calculations between expected and actual tonnes, grade, and ounces of mined material.

Trial mining across these variables will inform a confident and safe plan for mining the high-grade gold resources at Madsen.

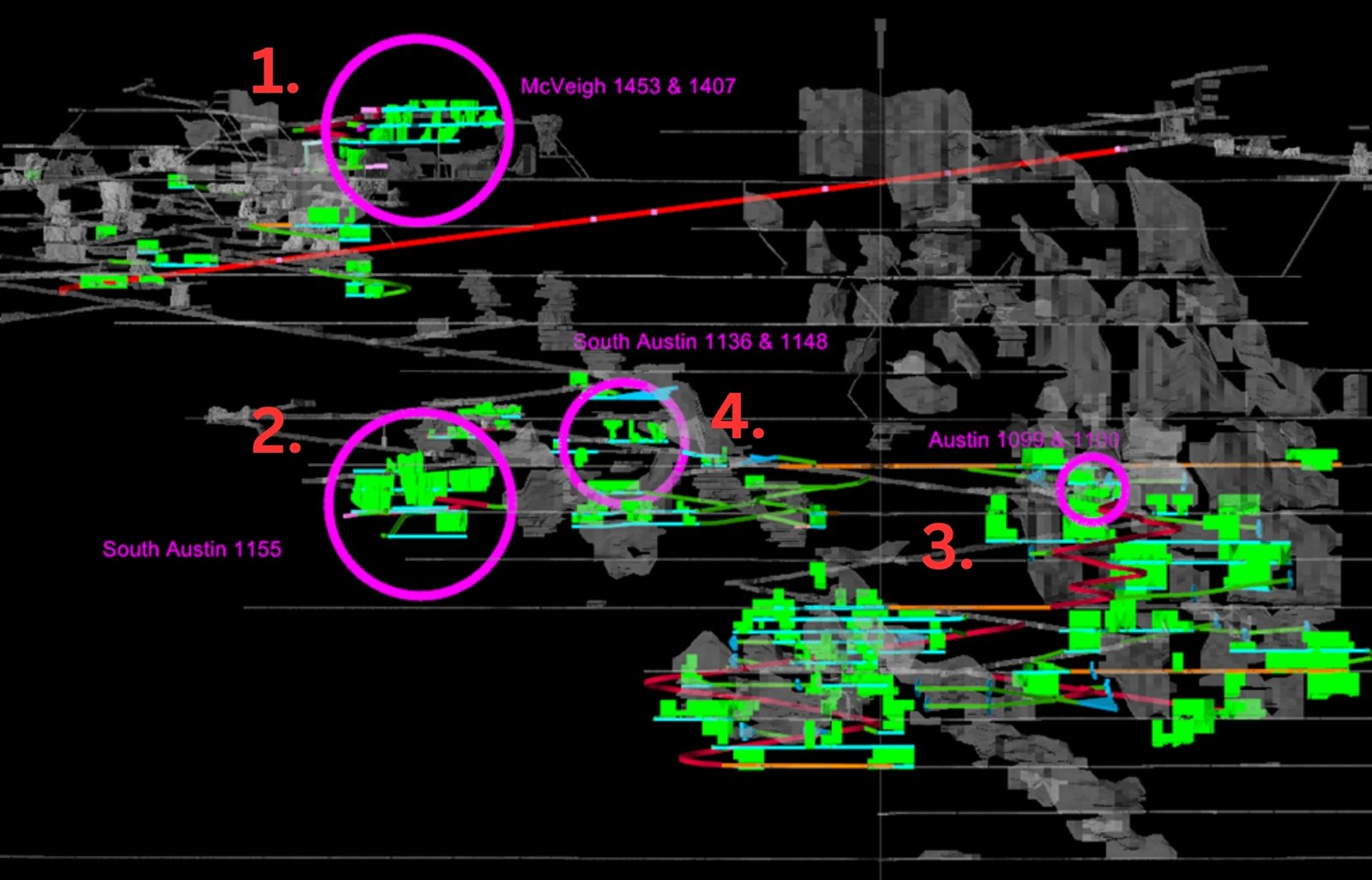

Above: A section view of the Madsen project with the four target areas for the test mining and bulk sample program noted.

1. McVeigh Lenses 1453 and 1406

Lenses 1453 and 1406 are a near-surface part of the McVeigh resource block. This area has an overall expected 26,300 tonnes at 7.15 g/t gold grade and will be mined exclusively with Long Hole Stoping (LHS). The sill levels are 18 metres vertically spaced, which leaves 15 metres for stoping.

This area was selected to add information to the resource model in the McVeigh area, which has higher geologic complexity than other parts of the Madsen resource, and to bulk sample a higher-grade part of the resource.

2. South Austin Lens 1155

The 1155 mining area is near the midpoint of the current mine, approximately 400 metres vertical below surface. This area has an overall expected 73,300 tonnes at 5.66 g/t gold grade. This complex is a fresh mining area, unencumbered by historical workings, and will be mined via LHS.

This test area will confirm geological modelling practices and the reliability of the sill engineering process. Drilling is currently ongoing in this area; results are expected to refine the total targeted tonnes and grade before test mining begins.

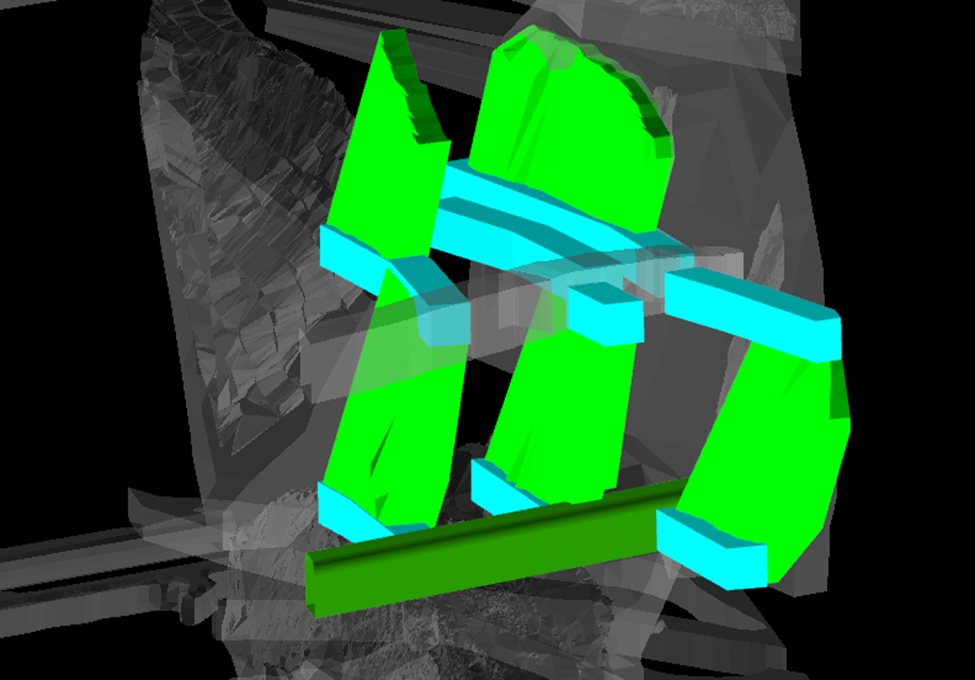

3. Austin Lens 1099/1100

The Austin Lens 1099/1100 is in an area of remnant mining. It has an overall expected 6,700 tonnes at 5.39 g/t gold grade. This area will be mined with a mixture of MCF and LHS.

This area will be test-mined to establish remnant mining procedures, partly by confirming the geotechnical competence of historical backfill, and to confirm historical data.

Above: An orthogonal view of the Austin 1099/1100 mining area showing planned sills (blue), stopes (light green), and access (dark green).

South Austin Lenses 1136 and 1148

This test mining area has an overall expected 8,300 tonnes at 5.60 g/t gold grade.

This area is being targeted to determine the accuracy of previous resource models and drilled areas, including understanding how best to assess sills that previous operators started in this area but did not complete.

On September 13, 2024, Shane Williams, President & CEO of West Red Lake Gold Mines updated Crux Investor about the mine re-start plan, including the test mining program announced on September 19, 2024.

“With the test mining, we’ll select a sample, mine it and bring it to surface,” Williams told Crux Investor. “Then we’re going to test samples on that, then run it through the mill. The objective is to prove that we’ve got the ore body right.”

WRLG expects to complete a pre-feasibility study (PFS) in support of that restart goal in 2025.

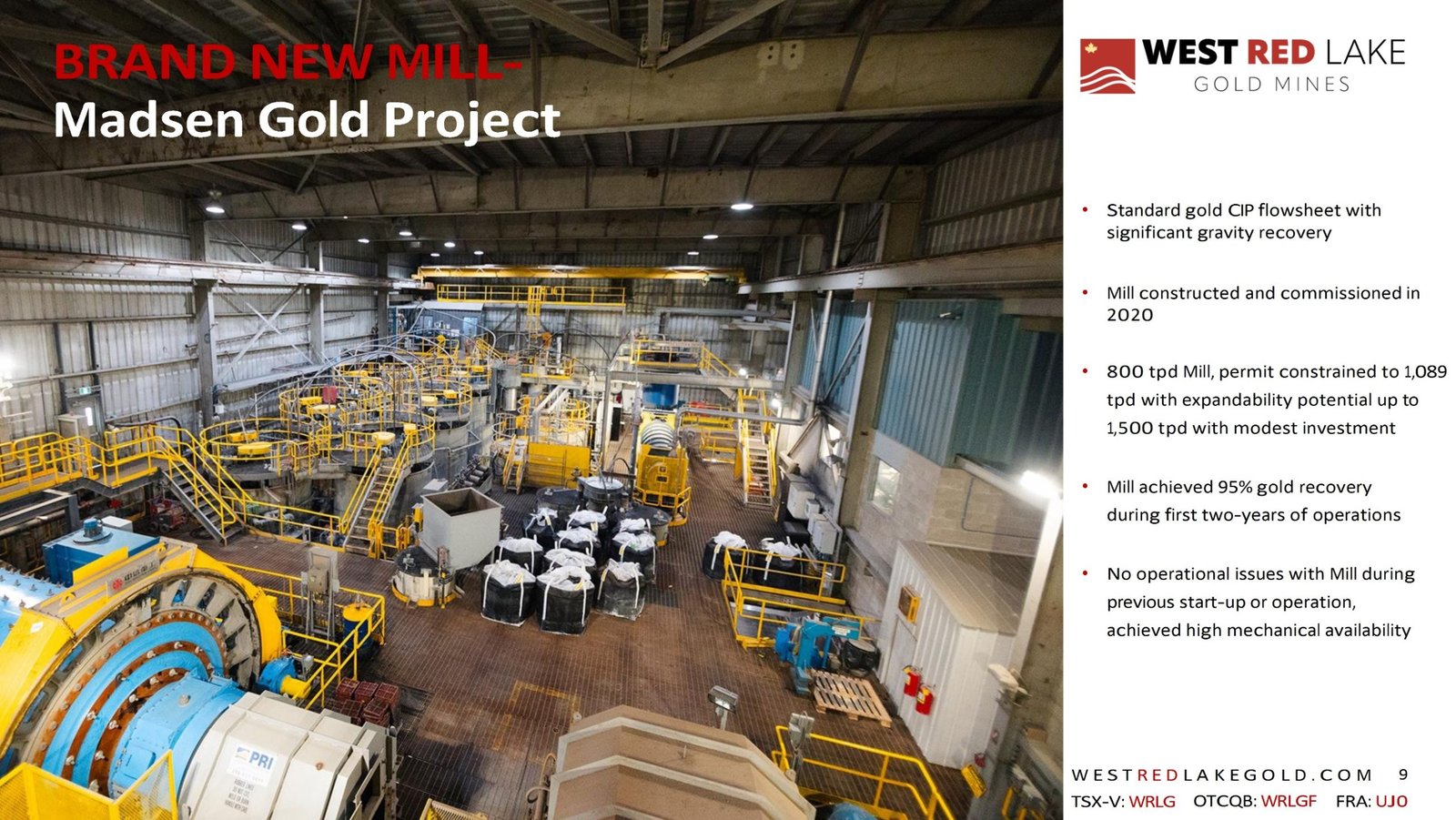

“The Madsen Mine PFS has a strong foundation of known variables, because Madsen is already largely built,” Williams told GSN.

“Typically, a PFS makes projections about geo-tech, metallurgy, mining methods, and process choices,” Williams continued. “Because Madsen was in operation recently, we have deep data on many of these factors, so the critical cost inputs for the PFS are actual, not estimated.”

“Gold continued to climb to new highs on Monday as traders digested fresh data showing a moderation in US business activity,” reports Mining.com on September 23, 2024.

“Bullion has advanced since the Federal Reserve lowered its benchmark interest rate by half a percentage point last week,” continued Mining.com. “Rate cuts are often seen as positive for the non-yielding gold.”

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain “forward-looking statements” such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca