Sponsored content disseminated on behalf of West Red Lake Gold. On August 27, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF reported drill results from the Austin and McVeigh zones at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

On June 5, 2024 WRLG stated that the company “has a goal to restart the high-grade Madsen gold mine in the second half of 2025.”

WRLG CEO Shane Williams’ specific expertise is moving mineral assets along the development chain into production, on schedule and on budget. He has designed, built and operated mines (open pit and underground) in Greece, Turkey and Canada – for Skeena Resources, Eldorado Gold and Rio Tinto.

West Red Lake Gold expects to complete a pre-feasibility study in support of the restart goal in the coming months.

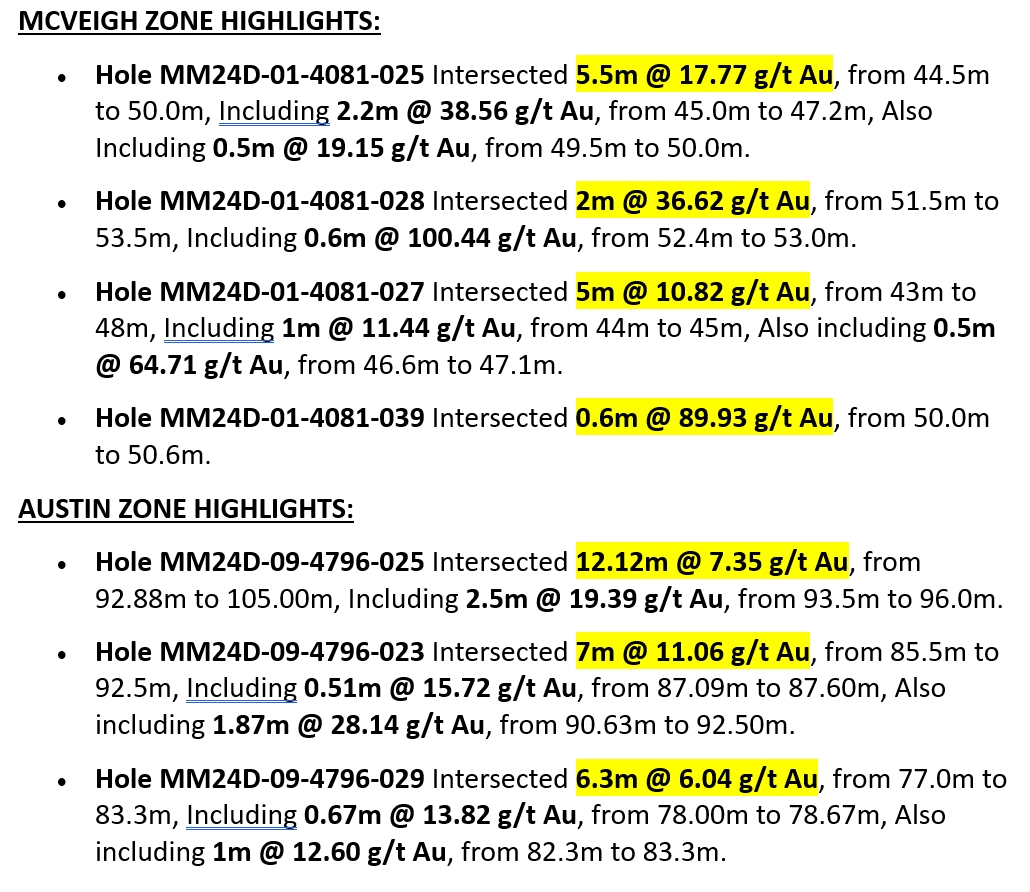

August 27, 2024 drill result highlights from the Austin and McVeigh zones.

These results follow-up on the significant intercepts previously announced on August 12, 2024.

“The August 12, 2024 drills results reported 107.61 g/t Au over 2.5 meters at Austin and 106.99 g/t Au over 2.35 meters at McVeigh,” Will Robinson, VP Exploration told Guy Bennett, CEO of Global Stocks News (GSN). “The August 27 results build on that, with McVeigh reporting 5.5 meters @ 17.77 grams per tonne gold, and 2 meters at 36.62 grams per tonne gold.”

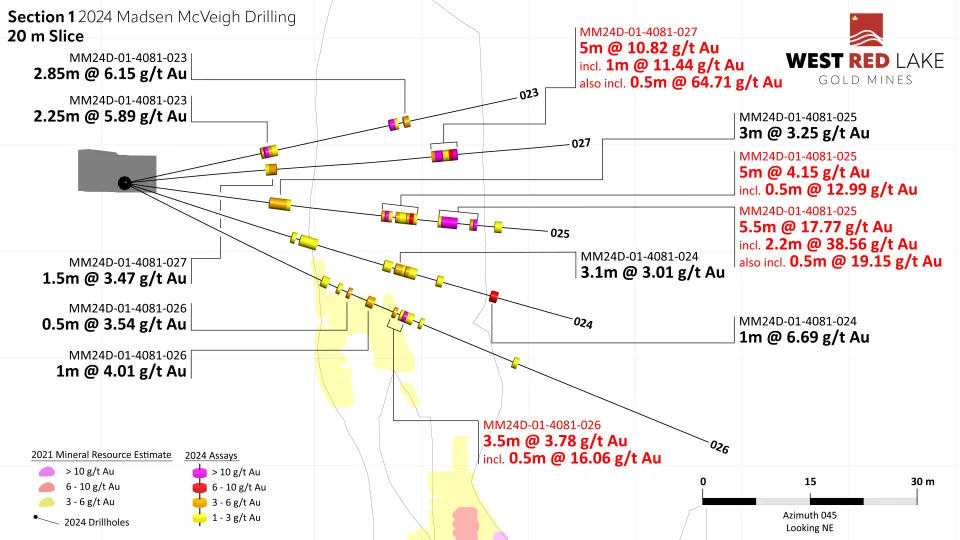

“McVeigh got a bad reputation during the Pure Gold era,” continued Robinson. “But they drilled at 20 meter spacing. Our definition drilling is at 6-8 meters. This, along with a much more detailed geologic interpretation, enables us to accurately define and model the gold mineralization within this zone.”

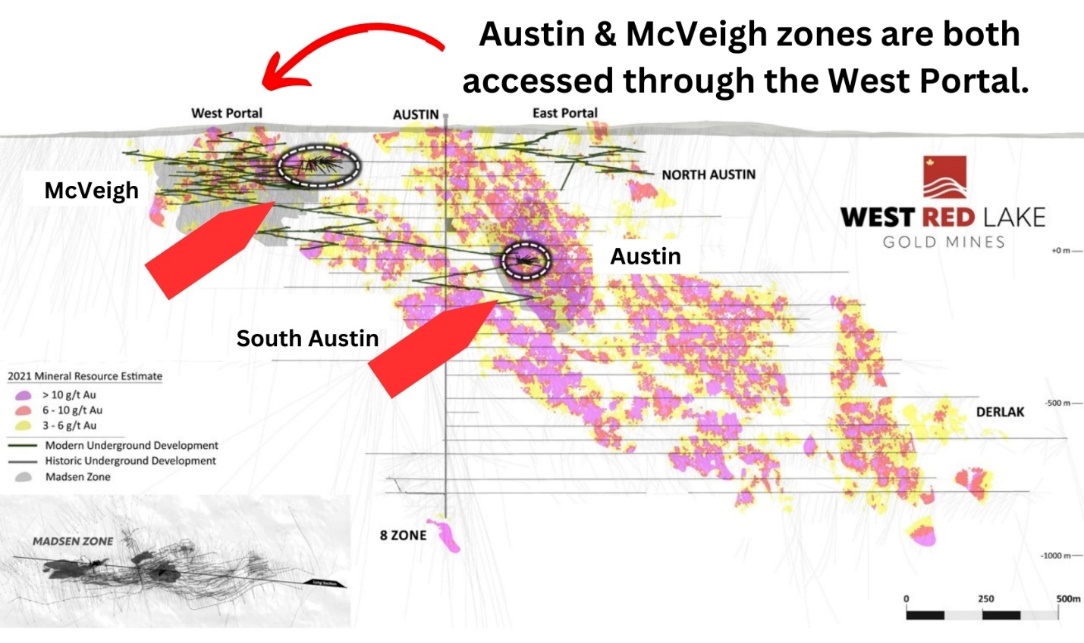

“McVeigh is structurally complex, but structural modification can also help to concentrate very high gold grades,” added Robinson. “Our recent drilling has demonstrated this high-grade potential. McVeigh is near surface, in the west part of the mine. It’s very close to the west portal providing short haulage distances, and has a lot of infrastructure around it.”

The definition drilling targeted priority areas of Austin and McVeigh to continue building an inventory of high-confidence ounces to support the restart of production at the Madsen mine.

The Austin Zone currently contains an Indicated mineral resource of 914,200 ounces grading 6.9 grams per tonne gold, with an additional Inferred resource of 104,900 oz grading 6.5 g/t Au.

The McVeigh Zone currently contains an Indicated mineral resource of 79,800 oz grading 6.4 g/t Au, with an additional Inferred resource of 14,300 oz grading 6.9 g/t Au.

On August 27, 2024 Crux Investor published a video interview with Shane Williams, CEO of West Red Lake Gold.

“We have 150 people on site now,” Williams told Crux Investor “We’ve got three drills on site and three development crews. We’ve done 1500 meters of underground development. We’re using that to set up drill stations so that we can get into the heart of the ore body using 6–8-meter spacings”.

“The Red Lake District is complex,” continued Williams. “There are broad lenses of mineralization, and within those lenses high grade veins that pinch and swell. It requires focused high-definition drilling”.

“There are some very deep mines operating in in the region,” said Williams. “Evolution is our neighbour. They’re down about 3,000 meters. The Madsen deposit was historically mined down to around 1,300 meters and remains open at depth. We have good geologic evidence that indicates the system continues past 1,300m.”

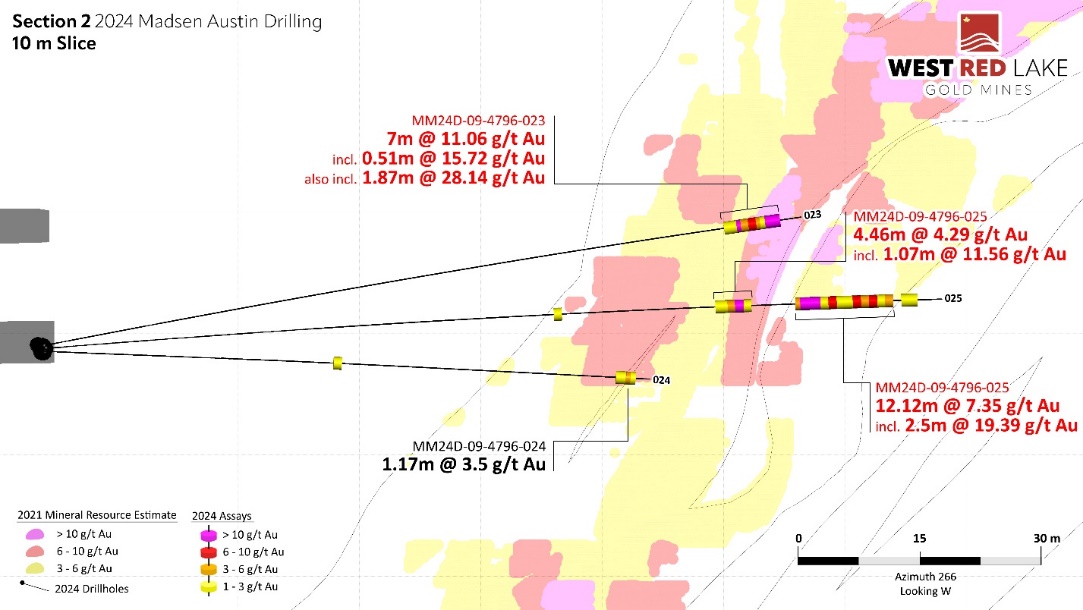

Above: Austin section view showing assay highlights for Holes MM24D-09-4796-023 through -025. [2] Holes -023 and -024 broke into historic stopes.

Above: McVeigh section view showing assay highlights for Holes MM24D-01-4081-023 through -027. [2]

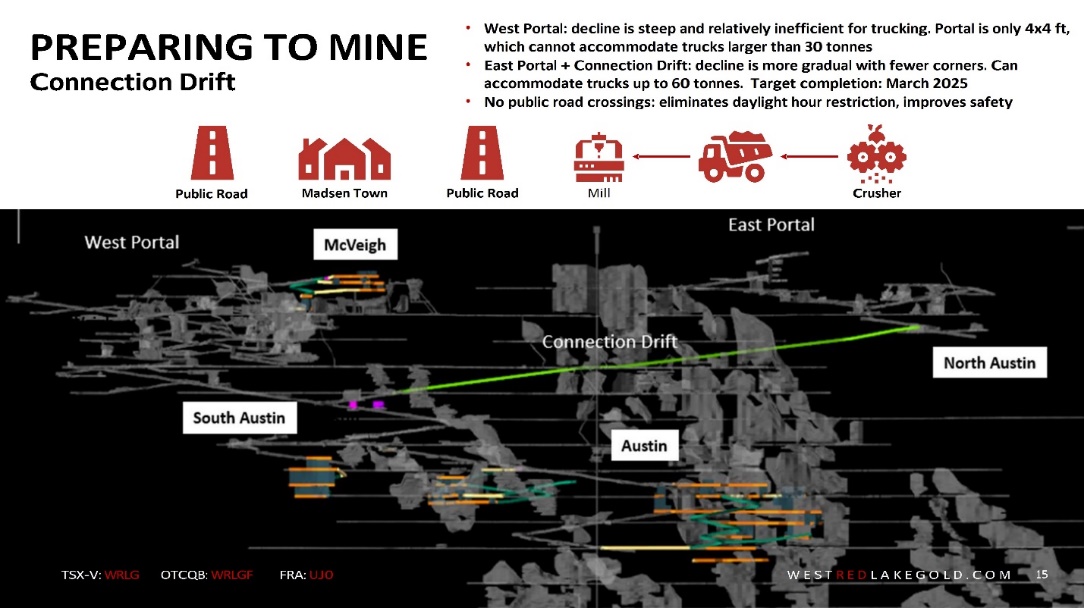

Concurrent with the 2024 drill program, mine restart projects underway or imminent include: underground development including access to planned near-term mining areas and a 1.2-km tunnel to connect the two sides of the mine, installation of a permanent primary crusher, test mining, mining camp construction, building staff facilities, installation of evaporator fans and a tailings dam lift.

“In a report published last week, market analysts at Bank of America (BoA) noted that gold is the best-performing asset so far this year,” wrote Kitco News on August 26, 2024. “With gold’s push to record highs above $2,500 an ounce, the precious metal is up roughly 20% in 2024.”

“Gold’s rally to record highs has been driven by record demand from central banks in the first half of this year,” wrote Kitco. “The BoA analysts said that investors should be taking their lead from central bankers.”

The Madsen Gold Mine is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 CND for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain “forward-looking statements” such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Website: Ministry of Northern Development, Mines, Natural Resources and Forestry. “MDI52K13NW00011 – Ontario Geological Survey.” Geology Ontario. Accessed August 15, 2024.