Shares of Twitter (TWTR:NYSE) spiked 22% Tuesday after Elon Musk revived his offer to buy the social networking app. Musk had earlier walked back on his initial offer to buy Twitter for $44bn on claims that the social media company misrepresented figures for the number of bots and fake accounts on the app.

Twitter subsequently sued him in the Delaware Chancery Court to force him to go through with the agreement. The trial was due to begin on October 17.

The social media company countered Musk’s ‘fake accounts’ claims stating he was looking for a way out after the share price dropped along with the rest of the market.

Mr. Musk had sought to amend his case to rescinding his earlier offer for Twitter by incorporating complaints from a former head of security at Twitter who came forward as a whistleblower in August, alleging problems with the platform’s data security and in other areas. The court allowed it, but there are no indications it would meaningfully strengthen Mr. Musk’s case.

Musk had initially shot himself in the foot by agreeing to skip due diligence, the deep-dive into a company’s health that most buyers insist on. That could have given him more insight into the prevalence of bots on the platform, an issue that has since appeared to consume him.

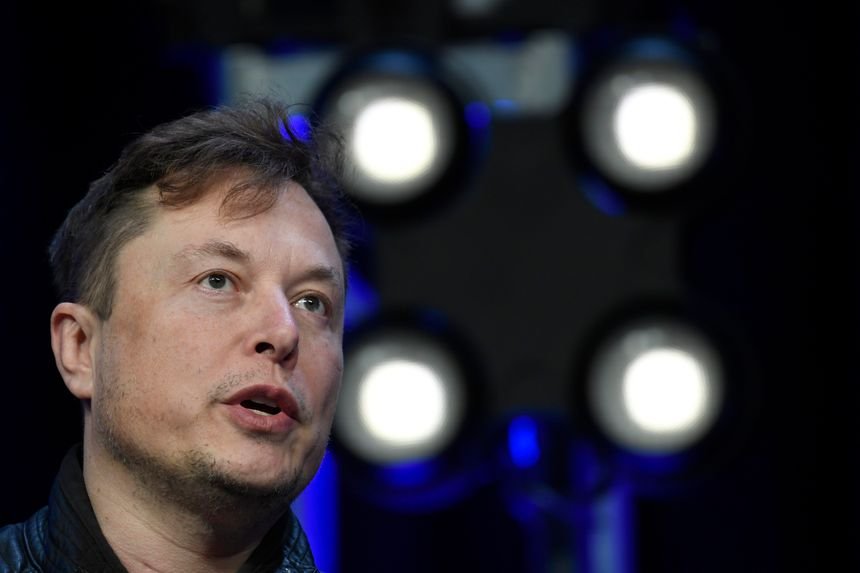

However, in a letter to Twitter filed on Monday with the Securities and Exchange Commission, the Tesla billionaire proposed the price, which equals the original valuation of $54.20 a share. Twitter confirmed receipt of the letter and said it intends to close the transaction at the original price.

Should the parties agree to do so, the proposal would enable them to avert a high-stakes trial set to begin soon and potentially finalize the deal within days. It would represent a major victory for the social-media company.

Analysts believe that the billionaire saw the writing on the wall and had come to the conclusion that he could lose his court battle against Twitter.

Mr Musk broke his silence on the deal on Twitter late Tuesday, writing: “Buying Twitter is an accelerant to creating X, the everything app”. He added that buying Twitter “accelerates X by 3 to 5 years”.

Mr Musk, the world’s richest man who is worth $220bn, gave no details of what his “X” app would look like, though he has previously expressed an interest in creating a “super app” similar to China’s WeChat.

Mr Musk told Twitter staff earlier this year: “Think of it like WeChat in China, which is great now, but there’s no WeChat equivalent outside of China. There’s a real opportunity to create that.”

He added: “You basically live on WeChat in China because it’s so helpful, so useful to daily life. I think if we achieve that or come even close to that with Twitter, that would be a success.”

In text messages between Mr Musk, his friends and advisers that were revealed as part of his court battle with Twitter, he revealed some details of his thinking about social media.

In one note to his brother, Kimbal, Mr Musk said: “I have an idea for a blockchain social media system that does both payments and short texts/links like Twitter. You have to pay a tiny amount to register your message on the chain, which will cut out the vast majority of spam and bots.

He later said his “plan B” is a “blockchain-based version of Twitter” where users would “pay maybe 0.1 Doge per comment”. Dogecoin is a joke cryptocurrency that Mr Musk has promoted in the past.

Twitter shares, which were halted for much of Tuesday, closed up 22% at $52. Tuesday’s closing price brings the stock closer to the price Mr. Musk agreed to pay when the deal was sealed in April