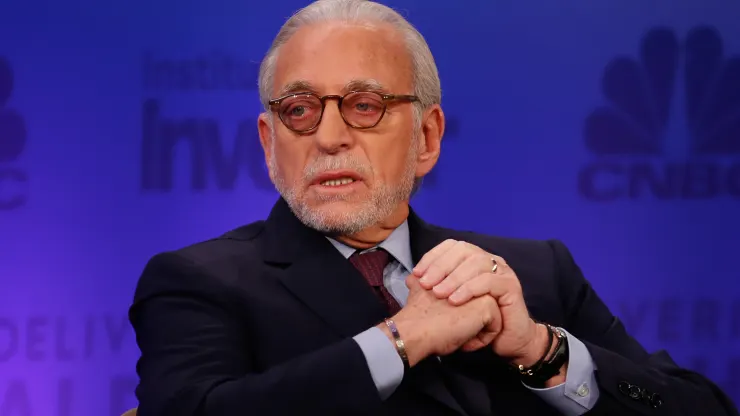

Activist investor Nelson Peltz called for Walt Disney Co. (DIS:NYSE) to find a clear successor to Chief Executive Bob Iger, improve streaming margins and pull its struggling studios out of their rut, intensifying his proxy battle ahead of the company’s annual meeting.

In a preliminary proxy statement filed with regulators Thursday, Peltz’s Trian Fund Management urged shareholders to cast their votes in support of adding Peltz and former Disney executive Jay Rasulo to the company’s board.

The campaign is one of several activist battles Disney is facing ahead of its shareholder meeting and as Iger works to chart the entertainment giant’s future in a turbulent market.

As of November, Disney’s streaming business had lost nearly $11 billion since the launch of Disney+ in late 2019.

Disney shares gained 3.7% for the week.

Court crashes Jetblue’s acquisition of Spirit Airlines

JetBlue Airways (JBLU:NYSE) and Spirit’s (NYSE: SAVE) merger won’t take off after all.

A federal judge on Tuesday blocked JetBlue’s $3.8 billion deal to buy Spirit Airlines, saying it would hamper competition and lead to higher fares.

The Justice Department sued last year to prevent JetBlue and Spirit from going ahead with their tie-up, which would have been the biggest U.S. airline merger in over a decade.

The decision could have repercussions for other airlines hoping to merge. Alaska Air Group (ALK:NYSE) announced plans in December to buy Hawaiian Airlines (HA:NASDAQ) in a $1 billion deal.

Spirit Airlines shares tumbled 56% this week, while JetBlue shares fell 1.6%.

Bank earnings kick off earnings season.

Goldman Sachs (GS:NYSE) quarterly profit jumped over 50%, as revenue in its asset- and wealth-management division rose 23%. Meanwhile, Morgan Stanley (MS:NYSE) said one-off charges helped send quarterly profit down 32% to $1.5 billion.

In their earnings report, JPMorgan Chase (JPM:NYSE) and Bank of America (BA:NYSE) on Jan. 12 suggested that consumers and businesses remained on strong financial footing last year, and showed how a one-time fee related to last year’s regional banking crisis weighed on the fourth quarter.

Morgan Stanley shares posted a weekly loss of 5.7%, while Goldman shares lost 0.3%.

TSMC sees a brighter year ahead for semiconductor makers

Taiwan Semiconductor Manufacturing (TSM:NYSE) said that it expects its revenue to grow over 20% in 2024—a stronger outlook than expected.

The largest contract chip maker and supplier to companies like Apple (APPL:NASDAQ), Nvidia (NVDA:NASDAQ) and Qualcomm (QCOM:NASDAQ) believes that chipmakers are going to have a profitable 2024.

In 2023, chip makers dealt with an inventory glut left over from the pandemic-era electronics boom. But the artificial-intelligence arms race is fueling a surge in demand, and the smartphone market is also recovering.

TSMC’s market value grew by roughly $31 billion to reach nearly $514 billion by the end of Friday, with its U.S.-listed shares finishing the week 12% higher.

Retail workers hit with more layoffs

Macy’s (M:NYSE) is cutting about 13% of its corporate staff and closing five stores to trim costs and redirect spending to improve customers’ shopping experiences.

Macy’s job cuts total roughly 2,350 positions, or 3.5% of the department-store chain’s overall workforce, excluding seasonal hires.

On Friday, online retailer Wayfair (W:NYSE) said it would lay off 13% of its staff, or around 1,650 employees. Chief Executive Niraj Shah told workers in a memo that the company “went overboard in hiring.”

Macy’s shares lost 6% for the week, while Wayfair shares finished 2.8% higher

Amazon faces obstacles in iRobot acquisition.

The European Union’s competition watchdog intends to block Amazon’s (AMZN:NASDAQ) $1.7 billion bid to purchase Roomba maker iRobot (IRBT:NASDAQ).

Amazon had agreed to buy the smart robot maker in August 2022. However, the European Commission formally raised concerns about the deal in November, saying it could restrict competition in the market for robot vacuum cleaners.

Amazon has been under intensifying antitrust scrutiny for its market power and the way the company competes. Last year, the Federal Trade Commission sued Amazon claiming that it maintains an illegal monopoly.

IRobot shares plummeted 44%, while Amazon shares ended the week flat.