On April 5, 2024 BacTech Environmental (CSE: BAC) (US-OTC: BCCEF) announced that it has filed an expanded patent application for industry’s first zero-waste bioleach process using green technology for metals recovery and fertilizer and steel production from sulphide minerals.

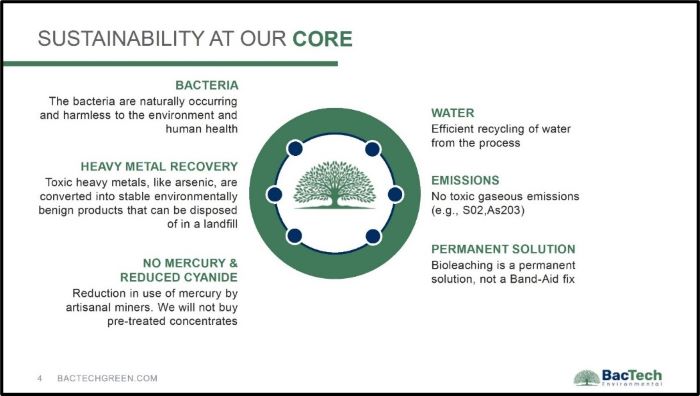

BacTech has developed an eco-friendly bioleaching process to recover metals like gold, silver, cobalt, nickel, and copper, while removing harmful contaminants like arsenic.

The proprietary process uses bacteria to neutralize toxic concentrates and tailings while creating revenue streams from precious and base metals.

BAC’s technology is in sync with the mining industry’s desire to attract younger environmentally conscious investors.

“Global ESG assets are $30 trillion, and on track to surpass $40 trillion by 2030,” reports a January 2024 ESG report from Bloomberg Intelligence.

“Investors’ desire to have more control and align their investments with their personal views is a major long-term shift that is still in the early innings,” states David Botset, at Schwab Asset Management.

“BacTech’s IP development path specifically aligns with broader trends across mining and steel industry operations, consistent with continued public and policymaker calls to shift processes and reduce carbon emissions,” confirms Ross Orr, President, and CEO of BacTech.

Key April 5, 2024 BacTech Highlights:

-

Company files expanded Provisional Patent Application for zero-waste bioleach process Intellectual Property (IP).

-

Engineered for eco-friendly nickel, copper and cobalt recovery from pyrrhotite and pyrite tailings, new zero-waste IP introduces novel methods for transforming remaining waste compounds into valuable, alternative green commodities.

-

Zero-waste IP now optimized to convert soluble iron into iron metal (produced on-site or as a feedstock to green steel making) and to create ammonium sulphate fertilizer from bioleach acid (sold as organic fertilizer).

-

Independent estimates suggest approximately 80 to 100 million tonnes of pyrrhotite tailings in the Sudbury, Ontario region alone (pyrrhotite and pyrite waste is common to many mining operations).

-

Testing and Collaboration with MIRARCO (Mining Innovation, Rehabilitation, and Applied Research Corporation) continues for pilot-scale bioleach circuit testing in Sudbury.

“The proprietary technology is appropriate to the commercial interests of non-ferrous metal production, steel making and fertilizer production which are all traditionally siloed as separate industries,” stated CEO Ross Orr.

“We believe our zero-waste metals recovery IP will emerge as a defining solution,” continued Orr. “By diversifying the range of products derived from these projects, BacTech aims to reduce dependence on long-term metal prices as the primary drivers for investment in remediation efforts while treating pyrrhotite and pyrite waste streams from current operations.”

BacTech plans to capitalize on fostering both sustainability and profitability in the industry by creating land value previously occupied by a legacy of mining industry waste.

Applicable to the treatment of existing pyrrhotite or pyrite tailings or streams from current operations, the primary products delivered through the new zero-waste, low-carbon bioleach processes specifically include:

-

Mixed nickel/cobalt precipitate.

-

Copper precipitate.

-

On-site iron metal production via electrowinning or iron pellets for off-site conventional iron manufacturing or green steel making.

-

Ammonium sulphate fertilizer.

-

Additional minor by-products such as magnetite powder and geopolymers silica for construction material or mine backfill.

The technology can also be adapted to recover precious metals and platinum group elements present in low grade pyrite feedstocks.

BacTech is confident that the new IP enhances project value by enabling the production of multiple products previously unattainable through conventional bioleach processing. Zero or minimal waste from remediation operations also converts previously unusable land into valued assets.

The core BacTech technology is described here:

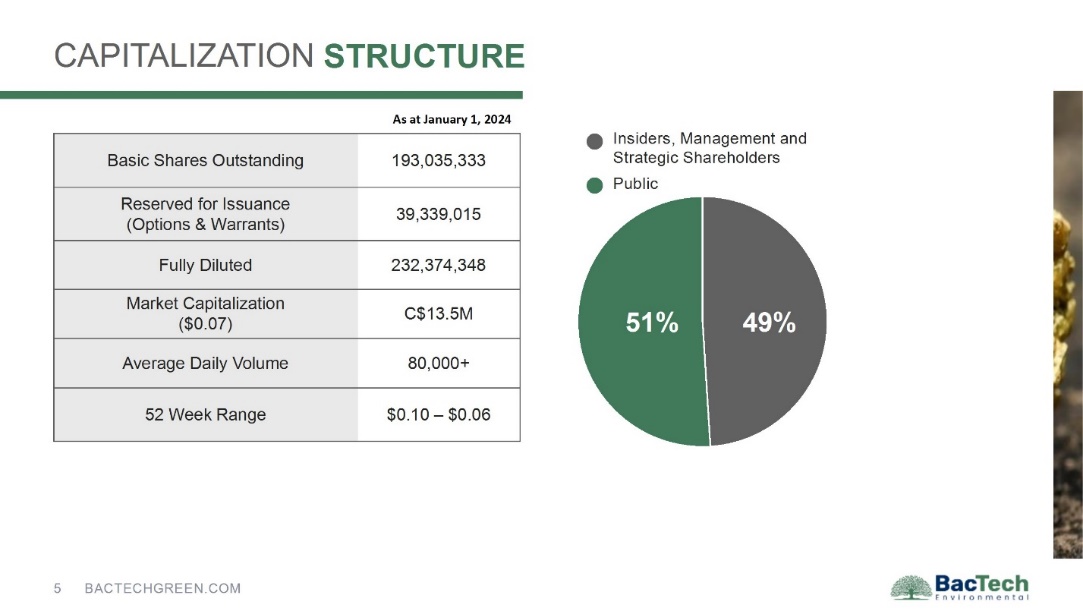

“We have a strong shareholder base,” Orr told Guy Bennett, CEO of Global Stocks (GSN) News. “One gentleman contacted me about nine years ago. He believes in our our vision and subsequently purchased 10 million shares. He has a network that he calls ‘The Millionaires Club’. About 60 of them purchased another 1 million plus shares. Some of those shares are in TFSA accounts for their grandkids. We are fortunate to have loyal long-term share-holders.”

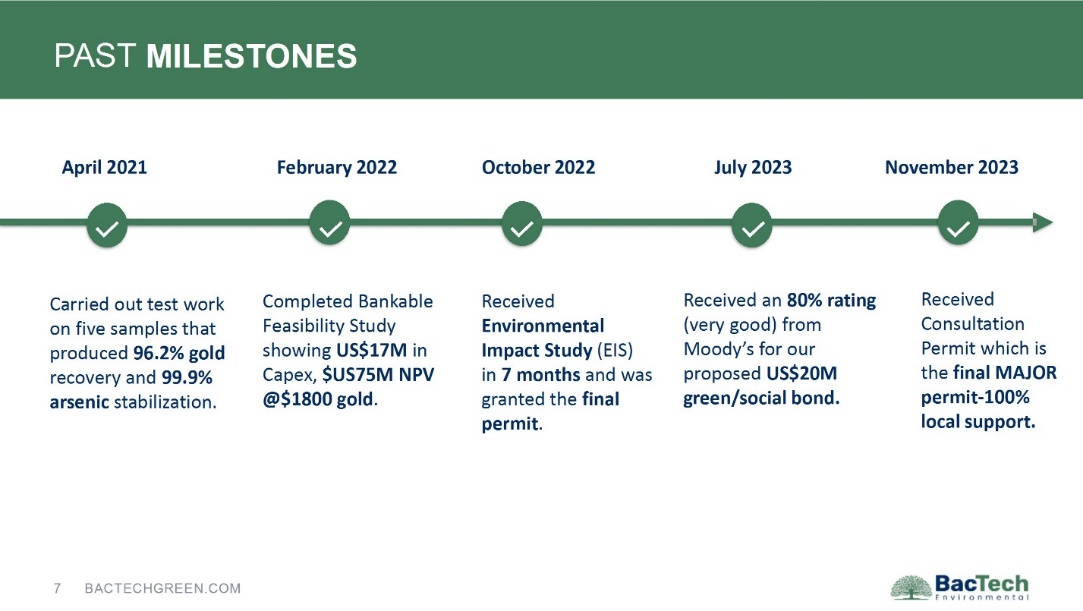

In November, 2023 BAC was granted its Consultation Permit. This approval allowed BacTech to move forward with plans to develop a bioleach processing facility in Tenguel, Ecuador.

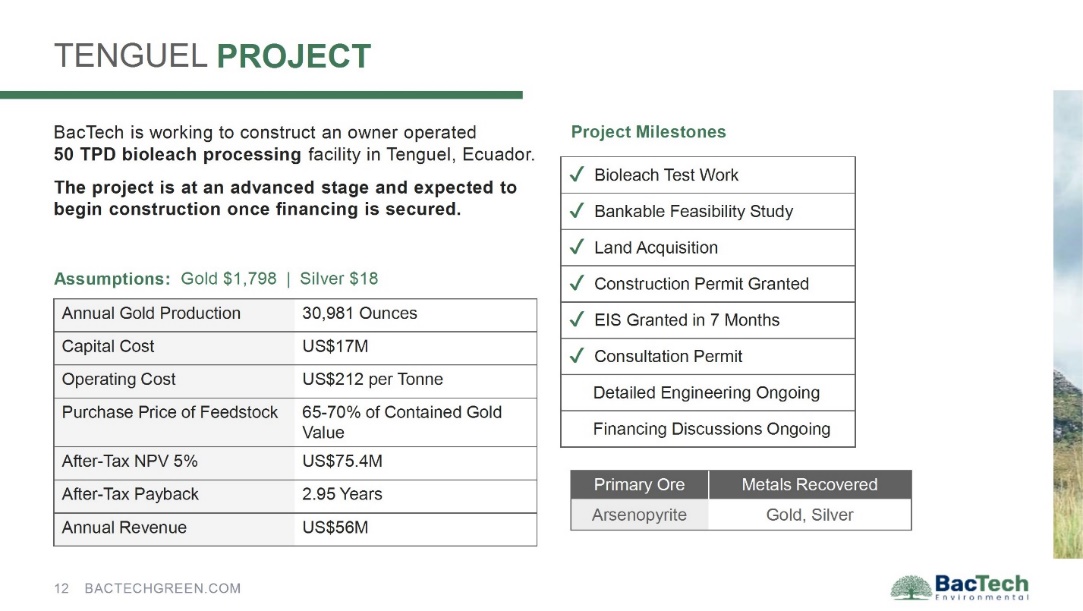

“With all major permits now secured and in place, BacTech will finalize the terms with Analytica Securities to launch the previously announced $US20M Green/Social bond issue to finance the construction of the bioleach plant at Tenguel,” reported BAC.

“Of the total funds raised, approximately $17 million will be allocated to the capital portion of the bioleaching facility construction, with the remaining $3 million dedicated to financing the purchase of concentrates from local miners and supporting the local economy.”

To ensure transparency and adhere to global best practices, BacTech launched its Sustainable Bond Framework for issuing Green and Social bonds, aligning with the International Capital Market Association’s (ICMA) Green Bond Principles (GBP) 2021 and Social Bond Principles (SBP) 2023.

The company also received an independent Second Party Opinion (SPO) from Moody’s Investors Service, granting BacTech a Sustainability Quality Score of SQS2 (Very Good), recognizing the company’s significant contribution to sustainability.

BAC intends to build a 50 tonne/day bioleach plant capable of treating high gold/arsenic material. Such a plant, processing feed with 1.75 ounces of gold per tonne, similar to what local miners provide, would yield approximately 31,000 ounces per year.

The modular plant designs allow for expansion without disrupting ongoing production. BacTech has also signed an International Protection Agreement (“IPA”) with the government for a Phase 2 plant that would add 150-200 tpd of capacity, producing more than 100,000 ounces per annum. Part of the agreement calls for BacTech to be non-taxable for 12 years.

“We have agreements in place with four Ecuadorian miners,” Orr told GSN. “These are not tiny artisanal miners. One of them has 400 employees. They currently sell to the Chinese, getting about 45-50 cents on the dollar for their gold content in the concentrates, depending on the arsenic levels.”

“We think we can offer the local miners a much better deal, treating the concentrates domestically, removing the arsenic before it leaves Ecuador.”

“The financial metrics on the Ecuador project are robust,” continued Orr. “We have a 12-year tax holiday. The feasibility study projects that, at $2,200/ounce gold, the annual profit will be equal to the capex of $17 million. Every $100/ounce rise in the price of gold adds a million dollars to the to the bottom line.”

This area of Ecuador hosts over 100 small mines, and BacTech is actively exploring the possibility of establishing modern bioleaching facilities in other regions of Ecuador, Peru, and Colombia.

The Accenture Global Institutional Investor Study of ESG in Mining surveyed decision-makers at 200 public and private institutional investment firms with mining assets in their portfolio valued at approximately US$847 billion.

The survey revealed that 59% of investors want miners to aggressively pursue ESG initiatives, and 63% of investors would be willing to divest or avoid investing in mining companies that fail to meet ESG and decarbonization targets.

MIRARCO (Mining Innovation, Rehabilitation, and Applied Research Corporation), has set up a pilot-scale bioleach circuit in Sudbury to conduct test work on BacTech’s technology.

BacTech presents an opportunity for ESG investors to buy shares in an innovative mining-related company that is positioned to do good things for the environment while generating a profit.

Contact: guy.bennett@globalstocksnews.com