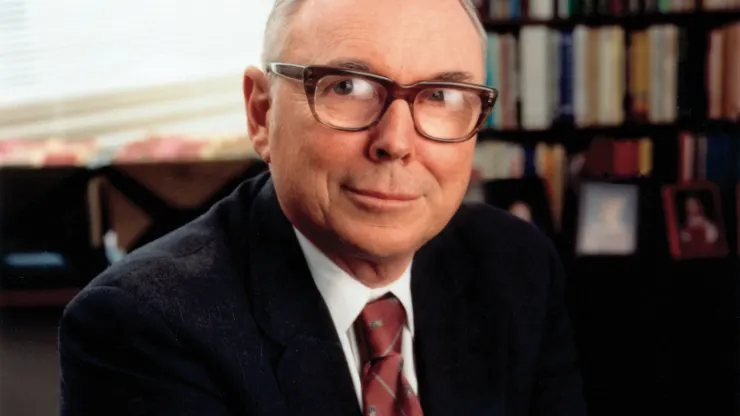

Charlie Munger passes away one month shy of his 100th birthday

The investment philosophy of Berkshire Hathaway’s vice chairman rubbed off generations of investors, but his longtime friend and business partner, Warren Buffett was the biggest beneficiary.

Munger’s approach to investing focused on buying quality companies selling at fair prices. He emphasized the importance of recognizing a good business before it’s widely seen as such, and he did so many times in his storied career.

This was a detour from Buffett’s strategy of buying dirt cheap, “cigar-butt” companies that might still have a little smoke left in them.

His approach paved the way for the sprawling conglomerate worth almost $800 billion that Berkshire is today.

Black Friday and Cyber Monday brings in big sales for online shopping firms.

E-commerce platform Shopify (SHOP:NYSE) said its merchants recorded $4.1 billion in Black Friday sales, up 22% from a year earlier. Including Cyber Monday, its merchants reached a record of $9.3 billion in sales, a 24% increase from 2022.

Meanwhile, shares of buy-now-pay-later platform Affirm(AFRM:NASDAQ) soared after a report from Adobe (ADBE:NASDAQ) said such transactions drove $760 million in online spending in Black Friday weekend sales, up 20% from last year.

Adobe also expects Cyber Monday to be the biggest online shopping day of all time, forecasting more than $12 billion spent by consumers.

Shopify shares climbed 4.9%, while Affirm shares leapt 43% for the week.

General Motors shifts gears.

General Motors (GM:NYSE) has announced plans for a $10 billion stock buyback for next year.

The share repurchase—GM’s largest in recent memory—is aimed to assuage investors about the health of its business amid setbacks in its electric-vehicle and driverless-car pursuits. GM will fund the buyback in part with capital previously earmarked for those areas.

The company also said it would work to offset higher labor expenses from its new contracts with unionized workers in the U.S. and Canada, which will add a total of $9.3 billion in costs over about four years.

General Motors shares finished the week 14% higher.

Salesforce beats analyst expectations

Salesforce (CRM:NYSE) posted strong earnings in its latest quarter, beating analyst expectations. This year, the company has focused on cutting costs and reducing staff to outweigh slowdowns in sales of its business software.

Salesforce is competing with rivals like Microsoft in the artificial-intelligence arms race, and has launched several AI products and tools.

Salesforce’s latest results impressed investors, and the stock led both the Dow and the S&P 500 during November’s final trading session. All three major U.S. stock indexes ended November at least 8% higher, snapping three-month losing streaks.

Salesforce shares soared 15% this week.

Tesla’s Cybertruck has finally arrived

Tesla (TSLA:NASDAQ) Chief Executive Elon Musk on Thursday unveiled the electric pickup, commemorating the official start of sales two years after its planned release.

The entry-level model of the truck—which has a unique angular design and stainless-steel exterior—sells for roughly $61,000. The price tag is about $21,000 more than Tesla previously specified in 2019. It will also sell two other, higher-end versions with the most expensive—the Cyberbeast—starting at nearly $100,000.

The delayed launch comes as Tesla faces increased EV competition, with automakers such as Ford Motor and Rivian Automotive beating Tesla to the market with electric pickups.

Tesla shares gained 1.4% this week.

Uber joins S&P 500

Uber (UBER:NYSE) shares rose 5% in extended trading on Friday after the ride-hailing company was added to the S&P 500 Index, replacing Sealed Air Corp.

Uber shares debuted on the New York Stock Exchange in 2019, but the company was burning cash as it had to pay drivers enough money to stay competitive in a low-margin business. Its preferred metric was adjusted earnings before interest, tax, depreciation and amortization, or EBITDA.

The change will take place before the open of trading on Monday, Dec. 18, according to a press release.

Uber shares finished the week 3.6% higher.