In a press release dated May 23, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) announced the appointment of Gwen Preston to the position of Vice President Investor Relations.

“At West Red Lake Gold, we are assembling an elite team of professionals,” Shane Williams, President and CEO of WRLG told Guy Bennett, CEO of Global Stocks News (GSN).

“Each component is vitally important: VP of Exploration, VP of Technical Services, VP of Community Affairs and the VP of Investor Relations,” continued Williams. “Gwen Preston is a big asset to our roster of VPs. She understands geology, demand drivers, political risks, the regulatory environment and the capital markets.”

“Gwen Preston brings over 16 years of experience in the resource sector as a highly regarded and accomplished newsletter writer and speaker,” Williams stated in the May 23, 2024 press release.

We asked Preston about her background.

“I did an undergraduate degree in science, then a master’s in journalism at UBC,” Preston told GSN. “The opportunities in science journalism were slim. I responded to a job posting at the Northern Miner, became interested in resource extraction, and ended up working there for seven years.”

“Between 2007 and 2014, I witnessed dramatic compressed market cycles. The great financial crisis, the quick rebound, then back into a bear market for precious and base metals.”

“Working for the Northern Miner, I traveled to projects all over the world. From Albania to South Africa, to Chile to Norway to Eritrea. These experiences alerted me to the importance of geopolitics as an investment risk.”

She then launched an independent newsletter. As the CEO of Resource Maven, Preston was buying and selling junior resource stocks with her own money and sharing her ideas with a subscriber base. She did not take money from the resource companies for coverage. Preston used her network to help investors get access to private placements.

“I was a bridge between the capital markets and retail investors,” confirmed Preston. “I also created a fair amount of educational content.”

In this March 30, 2024 Video: “Gold’s New Narrative: Exploring Sentiment and Dynamics Shifts: – Preston explains how the price drivers for gold are entering “a new frontier”.

“Gold has done things in the last few years that it just does not usually do,” explains Preston in the video. “In the last few months, gold has repeatedly stepped higher even though western investors have actually been selling gold.”

“Chinese and Indian investors have always bought gold when the price drops, and then stop buying when it gets expensive. These long held patterns are out the window.”

“Beijing offloaded a total of $53.3 billion of Treasuries and agency bonds combined in the first quarter,” wrote BNN Bloomberg on May 21, 2024. “With China selling dollar assets, its holdings of gold have risen in the nation’s official reserves. The share of the precious metal in the reserves climbed to 4.9% in April, the highest according to central bank data going back to 2015.”

“Beijing in the gold driver’s seat,” Preston told her YouTube viewers. “Western investors are just along for the ride. I don’t know how high China will push the price but they are buying with abandon and they have already pushed gold to record heights. This is a new frontier for gold.”

When Preston visited the West Red Lake Madsen Project nine months ago, she was there as an investor, to research the project and report to the Resource Maven subscriber base. She wasn’t looking to become part of the WRLG team, or to appear in their corporate video, but that is what happened.

“I first visited the Madsen project, back in 2014,” stated Preston (00:47). “The predecessor company came in and saw the opportunity. That there was still a bunch of high-grade gold in the ground. They dove into that opportunity. They defined the gold in the ground, they built the mill that you can see around me. They stumbled at the end. And that’s where West Red Lake Gold Mines is picking up the ball.”

“Shane Williams is the main reason I accepted the position of VP Investor Relations at West Red Lake Gold,” Preston told GSN. “Shane is a phenomenal person, an inspirational leader, and he is honest. Also, he has a lot of experience and success building mines.”

“I think all the WRLG managers will tell you, Shane asks a lot of you,” Preston continued. “The team always steps up, because of who he is and how he interacts with people. The Madson mine could stay medium sized and make money, or it could get very big. Either way, West Red Lake Mines does not plan to stop with just this one asset. That’s not what Frank Giustra does.”

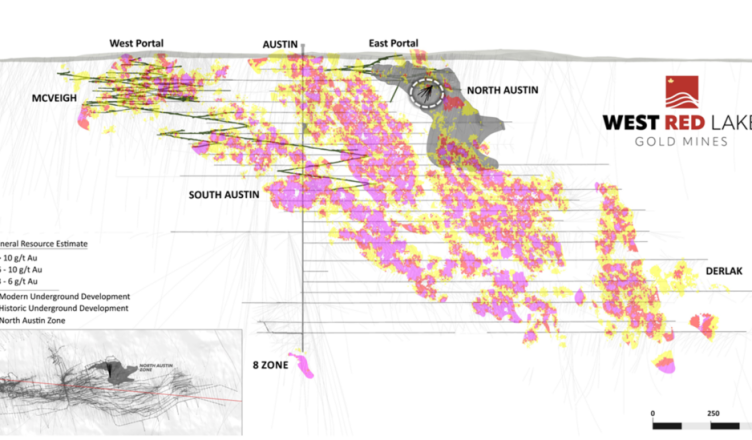

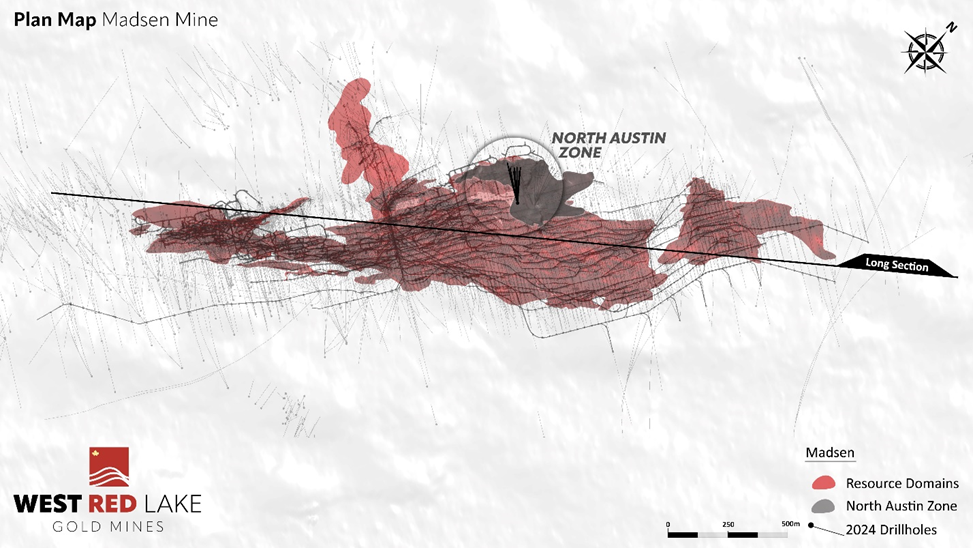

On May 21, 2024 WRLG reported underground drilling results from the North Austin Zone, which represents a new area of high-grade mineralization extending the current Madsen resource to the northeast. This program was designed to expand the North Austin zone down-plunge to the northeast.

The North Austin Zone sits adjacent to existing underground development marking it as a high caliber, near-surface target that could potentially be developed early during future mine restart and production.

The North Austin Zone remains open down-plunge and along strike to the northeast and will continue to be a priority expansion target as underground drilling continues.

HIGHLIGHTS:

-

Hole MM24X-03-5127-010 Intersected 2.79m @ 37.33 grams per tonne gold (“g/t Au”), from 124.21m to 127m, Including 1.0m @ 88.06 g/t Au, from 125.21m to 126.21m.

-

Hole MM24X-03-5127-011 Intersected 9.02m @ 5.26 g/t Au, from 53.06m to 62.08m, including 0.88m @ 22.34 g/t Au, from 58m to 58.88m, also Including 0.5m @ 26.18 g/t Au, from 61.08m to 61.58m; And 2.54m @ 5.21 g/t Au, from 118.46m to 121m; Including 0.61m @ 16.60 g/t Au, from 118.96m to 119.57m.

-

Hole MM24X-03-5127-007 Intersected 1.57m @ 25.12 g/t Au, from 128m to 129.57m, Including 1.0m @ 31.47 g/t Au, from 128m to 129m.

-

Hole MM24X-03-5127-001 Intersected 2m @ 9.5 g/t Au, from 72m to 74m, Including 1.0m @ 17.94 g/t Au, from 73m to 74m.

The current underground drilling program at the Madsen Mine is focused on further definition of near-term mining inventory, as well as growth of the current mineral resource.

Drilling has been focused on the more continuous and higher-grade portions of the Austin, South Austin, and North Austin Zones. This will continue to be the strategy moving into 2024.

The Madsen Gold Mine is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid GSN $1,500 CND for the research, writing and dissemination of this content.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca