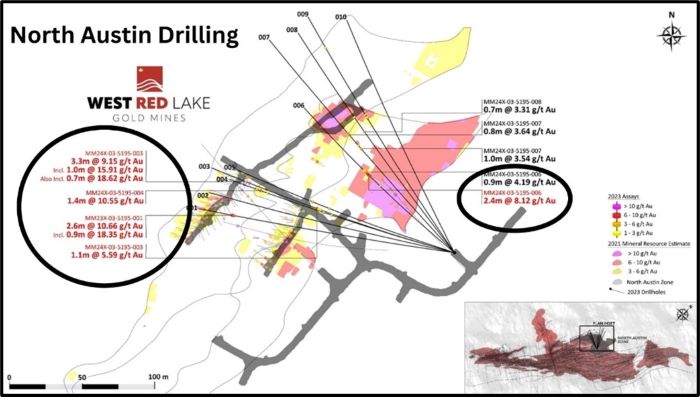

In a press release dated February 7, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) reported drill results from the North Austin Zone, which represents a new area of high-grade mineralization extending the current Madsen resource to the northeast.

The company’s flagship asset – The Madsen Gold Mine – is debt free, fully permitted, with a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [ 1 ]

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. [2.] [3.]

The current underground drilling program at the Madsen Mine is focused on definition of near-term mining inventory, as well as growth of the current mineral resource.

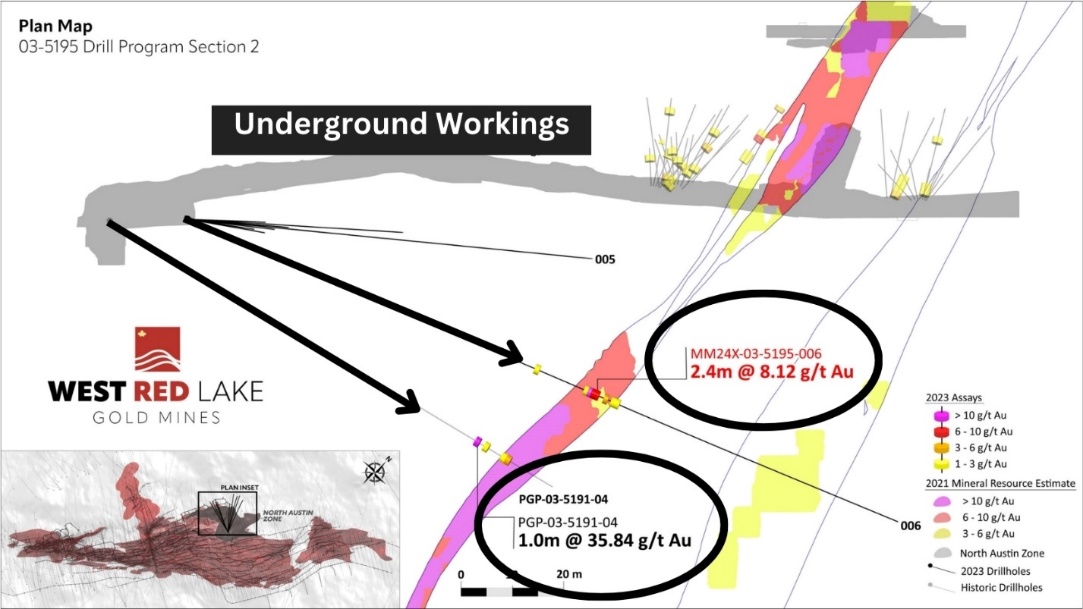

Hole MM24X-03-5195-006 intercepted 8.12 g/t Au over 2 meters, suggesting vertical continuity of almost two full mine levels, or approximately 50 meters, below any workings at the East Portal.

Additionally, holes MM24X-03-5195-001, -003 and -004 all intercepted high-grade mineralization beneath current workings effectively extending a known ore shoot approximately 25 meters down plunge.

The WRLG team believes these intercepts are indicative of the resource growth potential that still exists at the Madsen Mine asset.

The North Austin Zone sits adjacent to existing underground development marking it as a high caliber target that could potentially be developed early during future mine restart and production.

The North Austin Zone remains open down-dip and along strike to the northeast and will continue to be a priority expansion target as underground drilling continues.

HIGHLIGHTS:

-

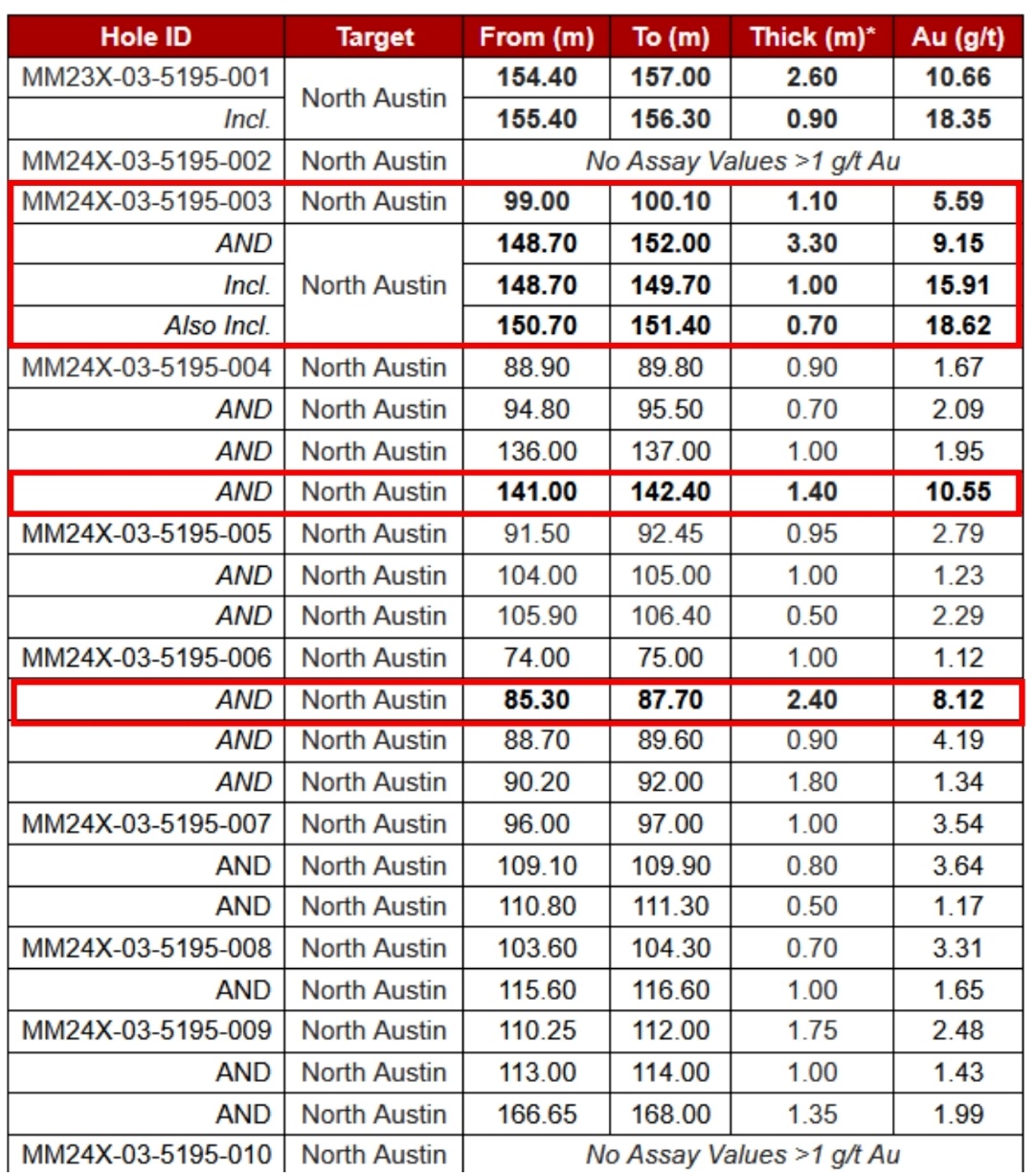

Hole MM24X-03-5195-003 Intersected 3.3m @ 9.15 g/t Au, from 148.7m to 152m, Including 1m @ 15.91 g/t Au, from 148.7m to 149.7m, also Including 0.7m @ 18.62 g/t Au, from 150.7m to 151.4m.

-

Hole MM24X-03-5195-001 Intersected 2.6m @ 10.66 g/t Au, from 154.4m to 157m, Including 0.9m @ 18.35 g/t Au, from 155.4m to 156.3m.

-

Hole MM24X-03-5195-006 Intersected 2.4m @ 8.12 g/t Au, from 85.3m to 87.7m.

-

Hole MM24X-03-5195-004 Intersected 1.4m @ 10.55 g/t Au, from 141m to 142.4m.

“This latest round of North Austin results are very encouraging and demonstrate the untapped growth potential that still exists in this part of the Madsen deposit,” stated Shane Williams, President & CEO of WRLG.

“There are two types of drilling we are currently doing underground at Madsen,” VP of Exploration Will Robinson confirmed to Guy Bennett, CEO of Global Stocks News. “We have expansion drilling – which is what we just completed at North Austin. It’s growth oriented, drilled at a wider spacing, to define a larger area. We process that data, get the assays back. If the results are favorable, we then follow-up with definition drilling, using tighter spacing, to bring that gold into the mineable inventory category.”

“That’s the plan at North Austin,” Robinson continued. “Go back in and drill with tighter spacing to increase confidence in this area.”

North Austin cross-section showing assay highlights for Hole MM24X-03-5195-006.[1]

*Geologic domains and 2021 block model have not yet been updated to incorporate drill results in this press release.

“The original geologic model that was used for mining by the previous operator did not capture the complexity of the Madsen deposit,” stated Robinson. “This resulted in excessive dilution during mining. The West Red Lake team now has a much more realistic geologic model and a proven workflow for accurately defining additional ounces. The current Madsen drill program, including the February 7, 2024 North Austin drill results, is feeding into that model and workflow.”

“We are now approaching Madsen as an advanced stage exploration project with near term development potential,” Robinson continued. “Our objective for the 2024 drill program at Madsen is to build a +1 year runway of high confidence ounces for the mill restart, while also taking full advantage of near-mine, high-grade resource expansion opportunities.”

“As we continue to advance the East Portal decline, we will be establishing additional drilling platforms to continue extending this zone at depth,” added WRLG CEO Shane Williams.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

Contact: guy.bennett@globalstocksnews.com