The CEO of Barrick Gold (GOLD.NYSE), Mark Bristow just stated that the gold industry needs to consolidate so it can put more gold assets in its pipeline, bulk up gold reserves, “lure more generalist investors and improve efficiencies”.

“Mergers and acquisitions are likely to dominate the sector in Africa, and are needed in Canada, where the world’s second-largest gold miner is based,” stated The Financial Post.

“While there was a scramble for deals after Barrick’s 2018 mega-merger with Randgold Resources Ltd. and Newmont Corp.’s subsequent acquisition of Goldcorp Inc., deals have slowed as gold’s rally to an all-time high this year pushed up the price of assets”

“In response to Covid, we’ve taken quantitative easing to another level, and of course that puts pressure on paper money, and you measure that with the price of gold,” Bristow noted. “We’ve seen prices go up across the world.”

“You’ve seen a shift in the base of the gold price,” Bristow said. “Added demand from China drove that initial gold price post-2005, as we came out of the hedging crisis. And then the mining industry itself added a whole lot of supply on the back of that rising gold price, and in fact in the process destroyed a lot of that value.”

Barrick recently purchased 8,000 coronavirus test kits to distribute to global employees at their mine sites, in response to the pandemic.

“Coming from Africa, we’re quite used to pandemics, and particularly viral pandemics,” stated Bristow, “We grew up with two bouts of Ebola, and the key thing about any viral crisis is to screen, identify, isolate, and test. That’s what we put in place across Barrick’s organizations, 14 different mines around the world, in February.”

Barrick’s objective is to acquire more tier-1 assets (output of at least 500,000 ounces a year).

Barrick’s challenges are shared by other big gold miners, like Newmont (NEM.NYSE), AngloGold Ashanti (AU.NYSE) and Kinross Gold (KGC.NYSE).

“Sixteen of the world’s 20 largest gold miners saw their levels of reserves drop between 2010 and 2019 — the most dramatic case being Toronto-based Kinross Gold beginning that period with enough reserves to last for 24 years but ending in 2019 with just nine years remaining,” stated S&P Global Market Intelligence.

In the past three years, there have been no major gold discoveries.

“S&P Global found that only China’s Zijin Mining and Mexico producer increased its reserves over the 2010-19 period, while South Africa’s Sibanye-Stillwater also grew reserves but it came into being only in 2013, while the other South African, Gold Fields (NYSE), saw its reserves remain unchanged at 20 years of supply,” stated the report.

Bank of America targets gold hitting USD $3,000/oz by 2022.

Global juniors and intermediate gold companies raised USD $1.48 billion in August, 2020 – USD $349.2 million more than in July, 2020. It was the fourth straight months of rising inflow into gold companie

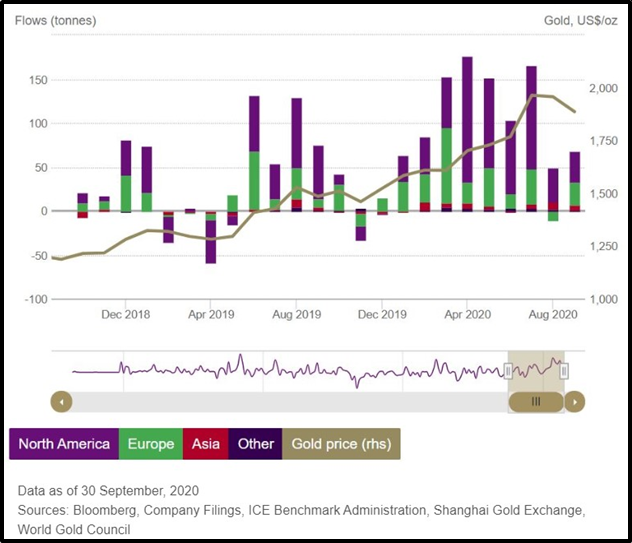

According to the World Gold Council (WGC), total ETF holdings worldwide rose for the tenth consecutive month in September, 2020 surpassing the 1,000-tonne mark for the first time ever in a calendar year.

By the end of September, gold ETF holdings increased by 68.1 tonnes ($4.6 billion) — or 2% of assets under management – despite a very bad month for the bullion spot price.

Meanwhile, the U.S. dollar index continued to weaken, which is bullish for gold (priced internationally in U.S. dollars).

“We’re giving investors the opportunity to have a self-funded insurance policy against a global financial crisis,” confirmed Barrick CEO Mark Bristow.