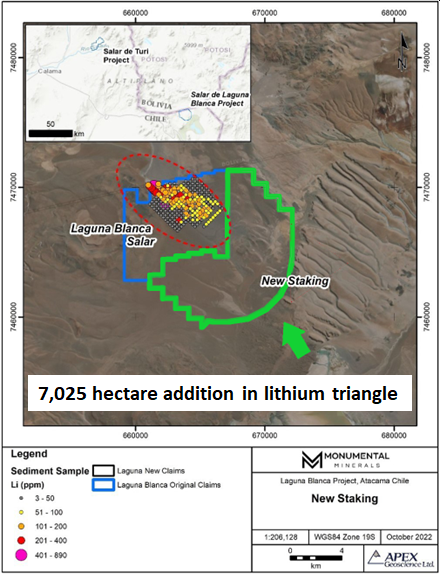

October 21, 2022 – TheNewswire – Global Stocks News – Monumental Minerals (TSXV:MNRL) (FSE:BE5) (OTCQB:MNMRF) has announced the addition of 7,025 hectares of land at the Salar de Laguna Blanca Lithium-Brine, Cesium-Sediment project.

Monumental Minerals is developing raw materials for the global energy transition, simultaneously advancing two projects in Chile as well as the Jemi HREE project in Mexico.

The 7,025-hectare addition is 17X bigger than Stanley Park, BC. The Laguna Blanca property now consists of exploration concessions totaling 12,425 hectares.

“We have drill targets established on Laguna,” MNRL Founder and Director Max Sali told GSN’s CEO Guy Bennett, “We’ve already done satellite spectral analysis on the 7,025-hectare land package extension.”

“We believe it’s important to lock down the surrounding area now, before a potential staking frenzy,” continued Sali, “As the additional land lies within the defined ‘area of influence’, we were able to acquire it without giving up shares of MNRL or cash.”

Lithium Chile staked an additional 9,600 hectares. 73% of the newly staked area falls under MNRL’s area of influence “AOI” of 5 kilometers, as per the March 31, 2022 Definitive Agreement between the two companies.

Monumental Minerals believes that the most important area of the additional 9,600 hectares staked by Lithium Chile is within the defined 5 km radius.

“We’ve expanded our land package at Laguna Blanca by about 130%,” MNRL CEO Jamil Sader told GSN, “our exploration area now encompasses pretty much the entire salar on the Chilean side”.

“Based on the geophysics, we’re confident that the brine layer we’re most interested in extends beyond the original claims,” continued Sader, “Our primary focus for Laguna Blanca hasn’t changed. And that is to drill, drill, drill.”

“Concurrent with that objective,” explained Sader, “we will conduct more geophysics on these new claims to establish additional drill targets. In an ideal world, after drilling the original claims, we’ll move the rig over to the new targets, accelerating the time-line while reducing exploration costs”.

Monumental’s Chilean team includes:

Caracle Creek Chile SpA: A local Chilean exploration consulting and project management group, Caracle has “specialized expertise in lithium and rare-element exploration.”

The company offers program design and guidance on regional exploration techniques, design and manage QA/QC programs; independent QA/QC reviews of assays and independent Technical Report Writing.

Atacama Water SpA: Hydrogeological site characterization and brine resource evaluation. The company offers baseline surface water and groundwater monitoring programs, community water usage evaluation, guidelines for sustainable water and brine abstraction.

Satelite SpA: Aligns legal, community and environmental strategies in order to achieve the development of sustainable projects in social, technical, environmental and financial terms, with a local vision.

“We are currently in communication and discussions with the local community,” reported Sader, “Which correctly has some influence over what happens at these lithium salars.”

“The discussions are going very well,” explained Sader, “They are an excellent group, experienced at working with other miners, like SQM and Albemarle.”

“Through Satelite SpA, we are supported by Daniela Rojas – a veteran mining lawyer from northern Chile – raised in Copiapó, specialising in indigenous relations,” stated Sader, “She has a proven track record in this field and is respected by the local communities.”

Lithium demand – driven by EV sales – is expected to rise from 500,000 metric tons in 2021 to 3 or 4 million metric tons in 2030.” Chile holds half the world’s lithium reserves.

Further north in Chile, Monumental has been aggressively expanding its footprint.

On October 6, 2022, Monumental announced that it has signed a definitive option agreement with Lithium Chile to acquire a 50.01% interest in the Salar de Turi project.

The Turi Project is located about 120 km northwest from the Salar de Laguna Blanca and 60 km northeast from the city of Calama, Chile. It contains 40 exploration concessions totaling 8,500 hectares.

Surging lithium demand, “coupled with a structural deficit in supply that looks set to last for years, has sent countries and carmakers scrambling to secure resources,” reports Foreign Policy.

Currently, about 1% of the 250 million vehicles on North American roads are electric. An analysis by IHS Markit projects that 25% of new car sales will be electric by 2030.

Recent Laguna Blanca sediment samples returned values of 1450 ppm lithium, and 690 ppm cesium. Cesium – a specialised industrial lubricant – sells for about $100/gram, making a single wheelbarrow of Cesium worth $12 million.

“Our expectation is that we will be drilling Laguna Blanca in Q1 2023”, concluded Sader.

Contact: guy.bennett@globalstocksnews.com